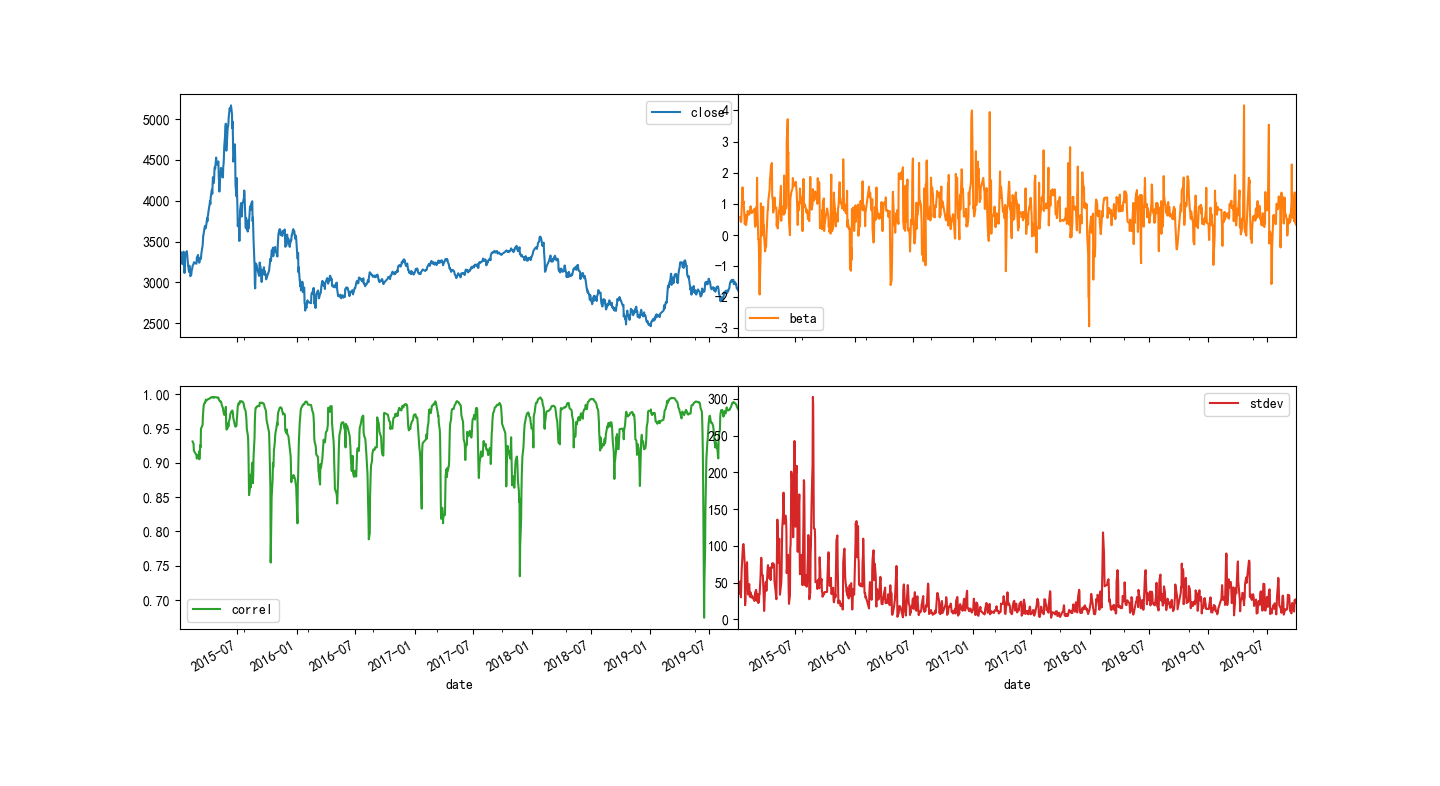

TA-Lib提供了常用的基础统计学函数,基于时间序列移动窗口进行计算。注意TA-Lib的beta,示例中是求某只股票的最高价与最低价序列的移动beta值,默认时间周期为5日,而资本资产定价中一般是分析某只股票相对于市场(大盘指数)的波动情况。

BETA : Beta Coefficient Capita Asset Pricing Model(CAPM) 资本资产定价模型里的beta系数:

ta.BETA(high, low, timeperiod=5),求两个序列的移动beta值(回归分析)

CORREL : Pearson's Correlation Coefficient(r) 皮尔逊相关系数:

ta.CORREL(high, low, timeperiod=30)

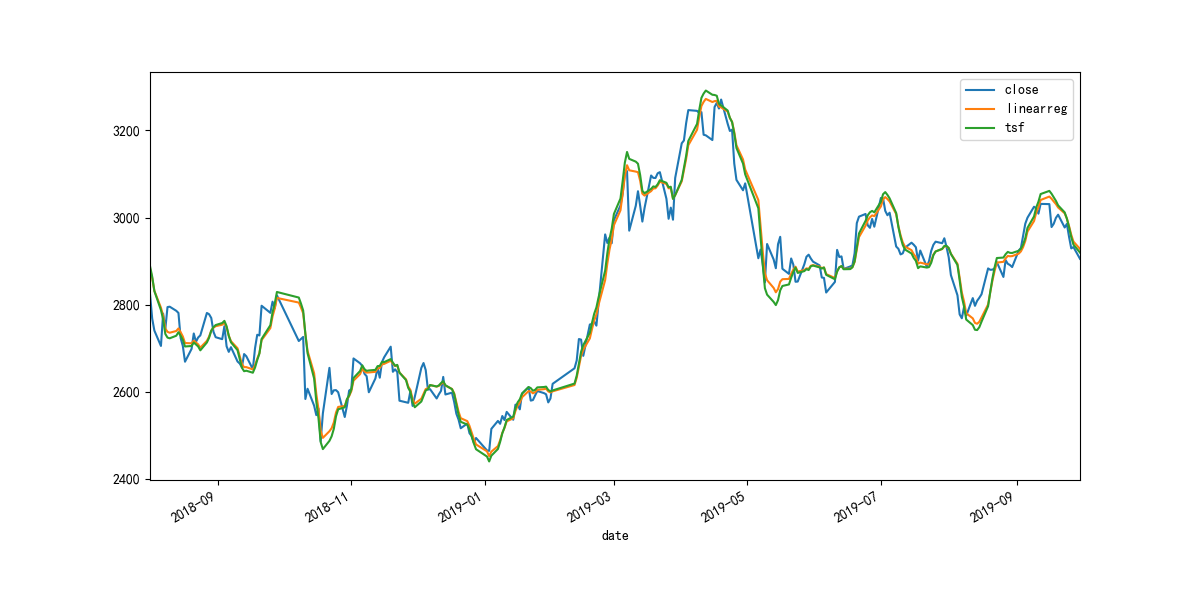

LINEARREG : Linear Regression 线性回归:

ta.LINEARREG(close, timeperiod=14),收盘价序列对时间t的线性回归,并输出预测值

LINEARREG_ANGLE : Linear Regression Angle 线性回归斜率的正切角度:

ta.LINEEARREG_ANGLE(close, timeperiod=14)收盘价序列对时间t的线性回归,并输出预测值

LINEARREG_INTERCEPT : Linear Regression Angle 线性回归截距:

ta.LINEARREG_INTERCEPR(close, timeperiod=14)

LINEARREG_SLOPE : Linear Regression Slope 线性回归斜率:

ta.LINEARREG_SLOPE(close, timeperiod=14)

STDDEV : Standard Deviation 标准差:

ta.STDDEV(close, timeperiod=5, nbdev=1),默认每5个收盘价计算标准差

TSF : Time Series Forecast 时间序列预测:

ta.TSF(close, timeperiod=14)

VAR : Variance 方差:

ta.VAR(close, timeperiod=5, nbdev=1)

import pandas as pd import numpy as np import matplotlib.pyplot as plt import talib as ta import tushare as ts plt.rcParams['font.sans-serif'] = ['SimHei'] plt.rcParams['axes.unicode_minus'] = False def get_data(code, start='2015-01-01'): df = ts.get_k_data(code, start) df.index = pd.to_datetime(df.date) df = df.sort_index() return df df = get_data('sh')[['open','close','high','low']] df['linearreg'] = ta.LINEARREG(df.close, timeperiod=14) df['tsf'] = ta.TSF(df.close, timeperiod=14) df.loc['2018-08-01':, ['close','linearreg','tsf'] ].plot(figsize=(12,6))

df['beta'] = ta.BETA(df.high, df.low, timeperiod=5) df['correl'] = ta.CORREL(df.high, df.low, timeperiod=30) df['stdev'] = ta.STDDEV(df.close, timeperiod=5, nbdev=1) df[['close', 'beta', 'correl','stdev'] ].plot(figsize=(18,8), subplots=True, layout=(2,2)) plt.subplots_adjust(wspace=0, hspace=0.2)