this lesson => Buffet said two things

=> (1) investor skill

=> (2) breadth / the number of investments

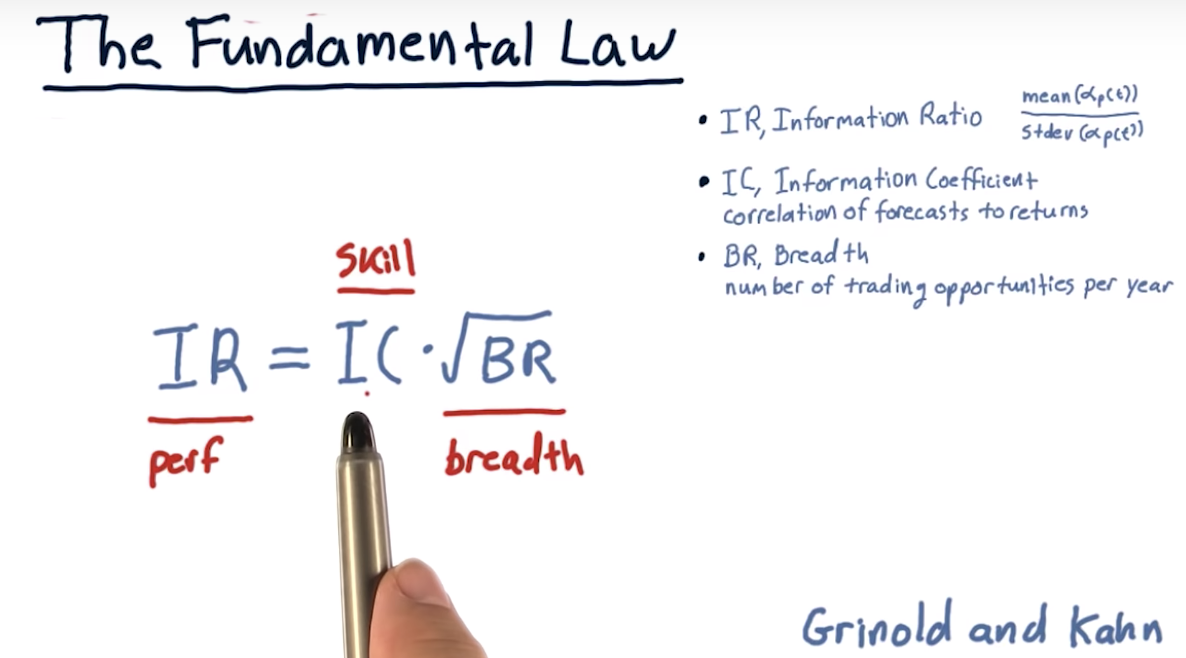

Grinold's Fundamental Law

breadth => more opportunities to applying that skill => eg. how many stocks you invest in

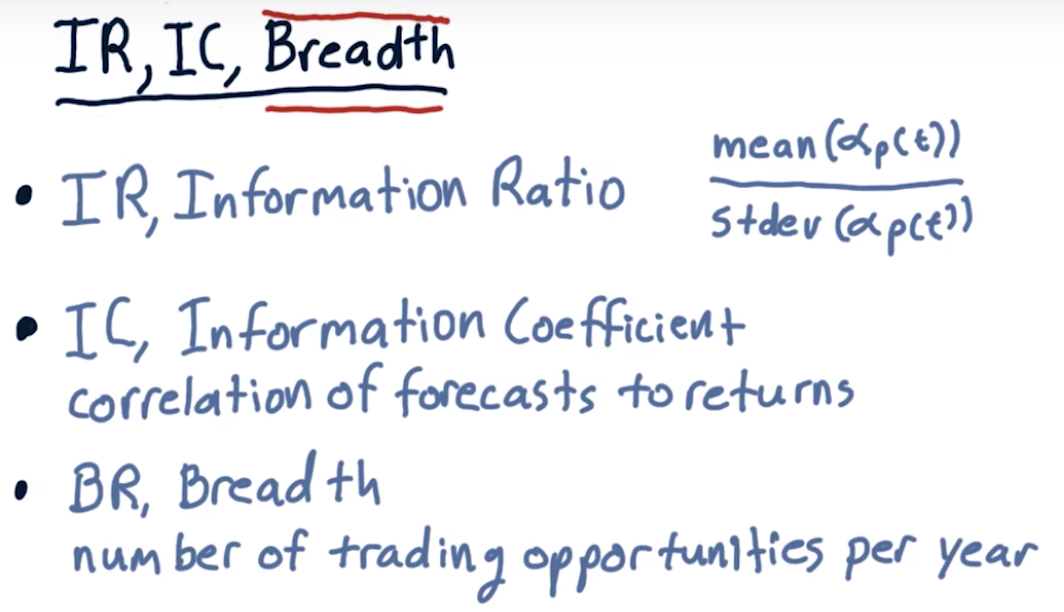

IC => information coefficient

BR => breadth / how many trading opportunities we have

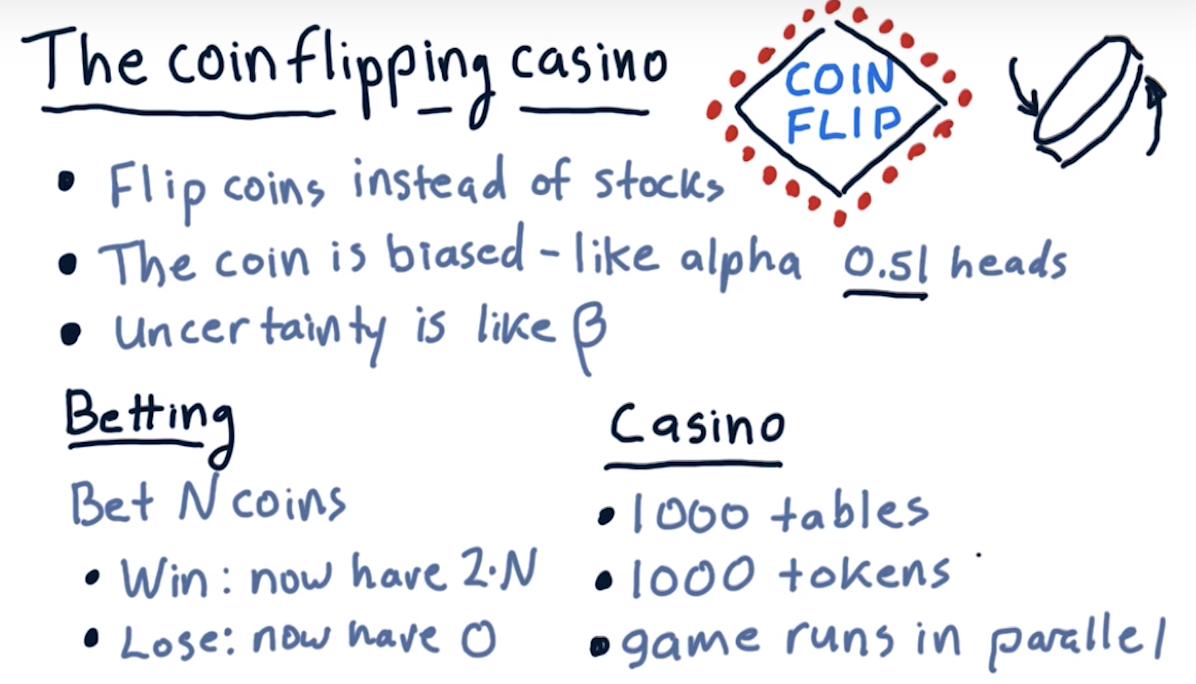

The Coin Flipping Casino

Which bet is better?

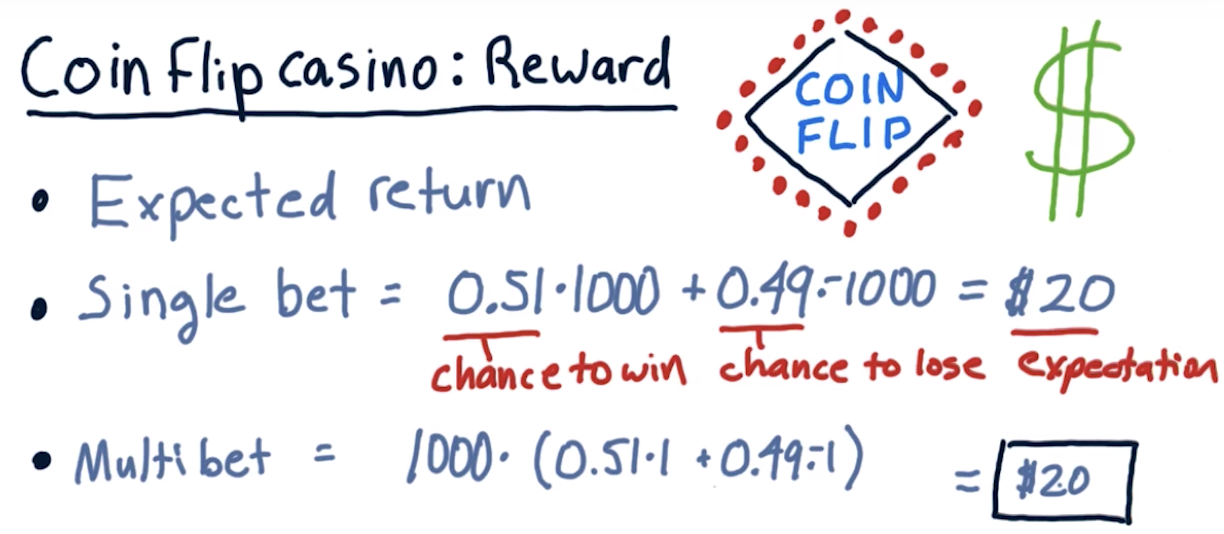

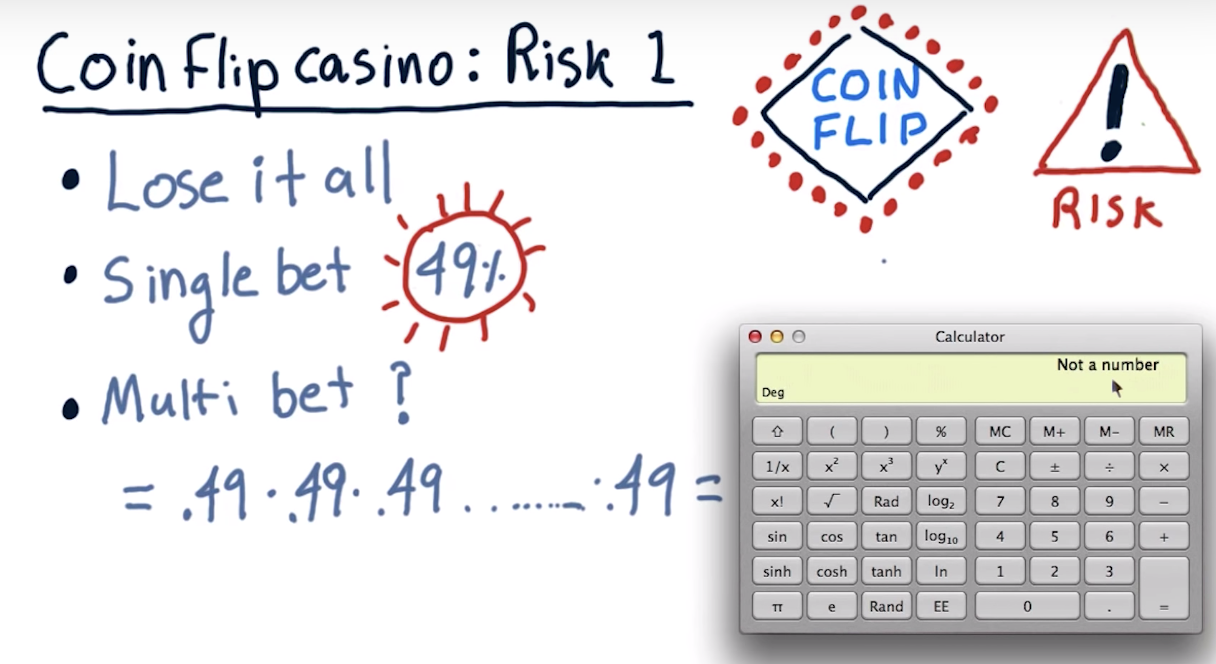

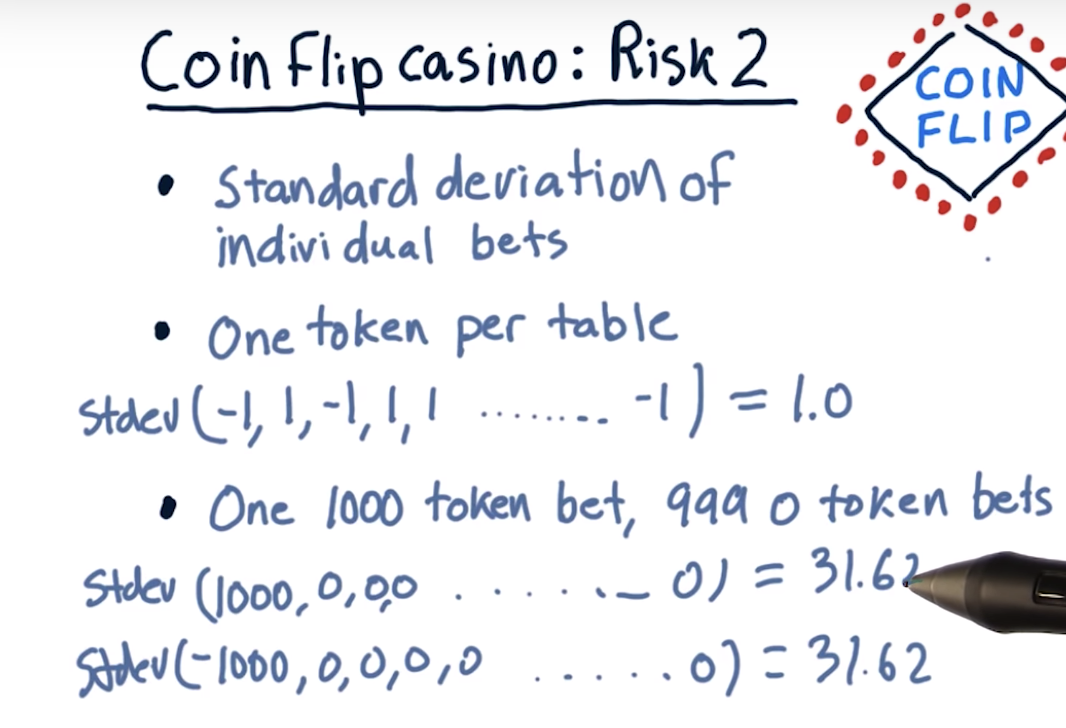

Coin-Flip Casino: Risk

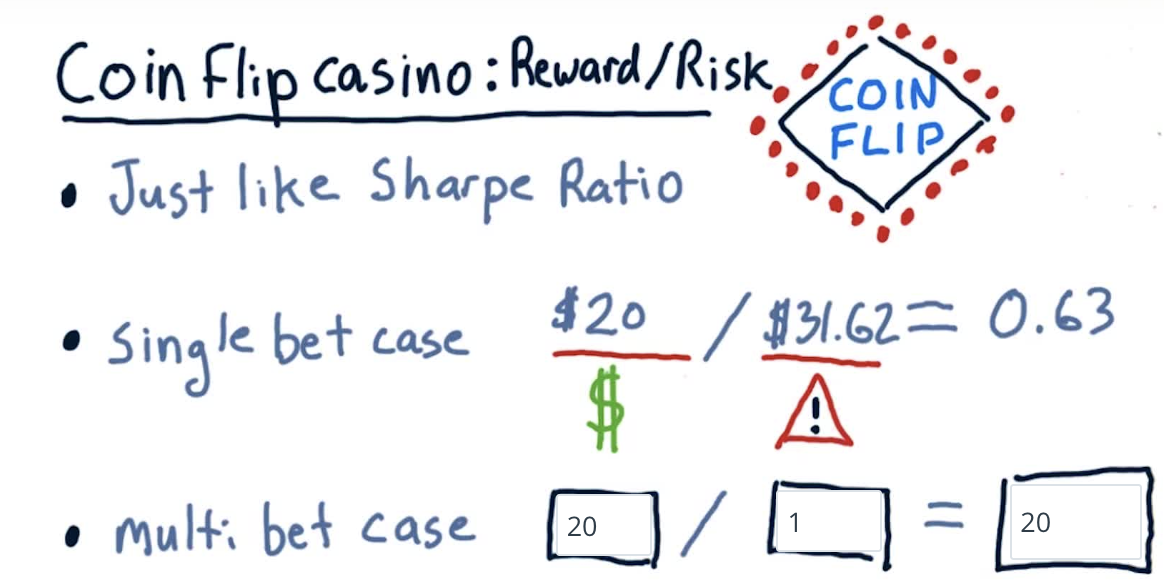

Coin-Flip Casino: Reward/Risk

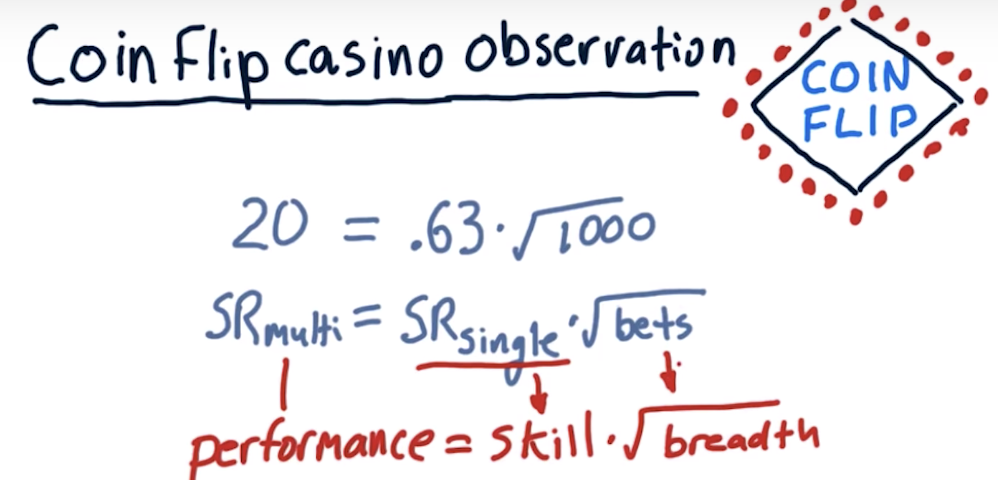

Coin-Flip Casino: Observations

Coin-Flip Casino: Lessons

(1) higher alpha generates a higher sharpe ratio

(2) more execution opportunities provides a higher sharpe ratio

(3) sharpe ratio grows as the square root of breadth

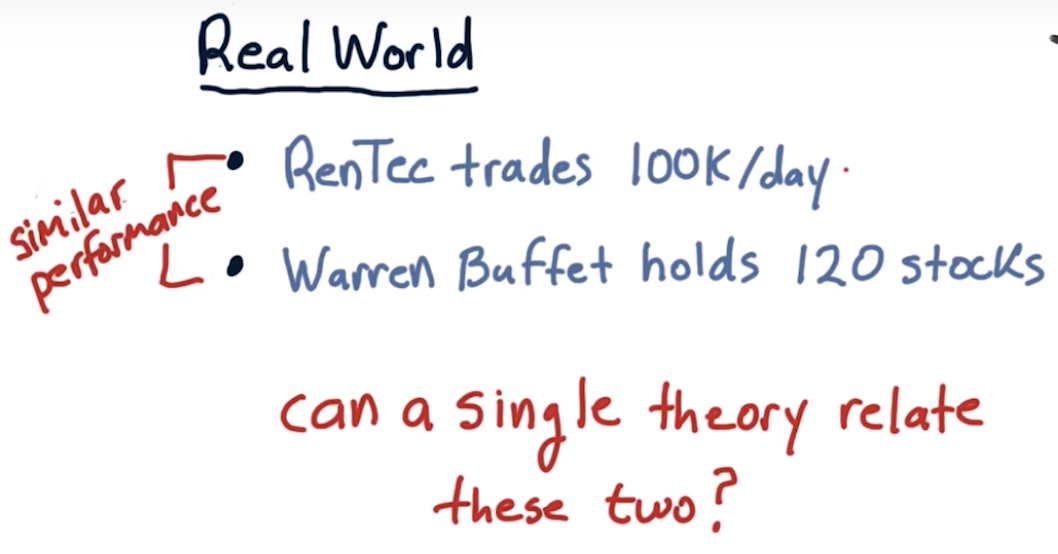

Back to the real world

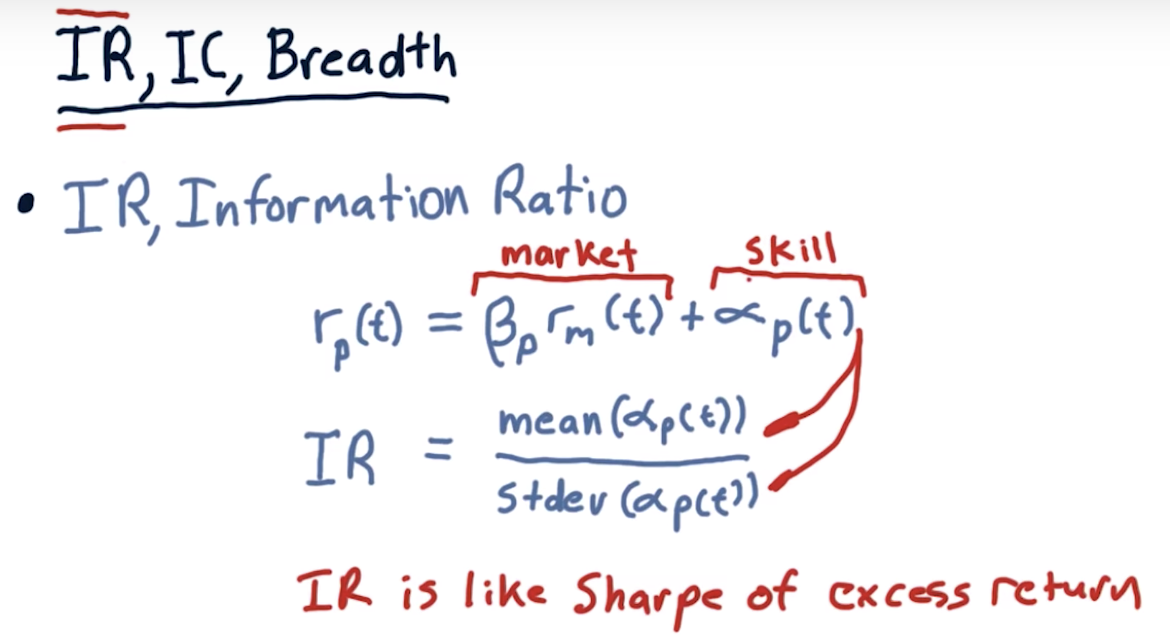

IR, IC and breadth

The Fundamental Law

skill is harder to be increased than breadth

Skill => introverted

Breadth => extroverted

Simons vs. Buffet

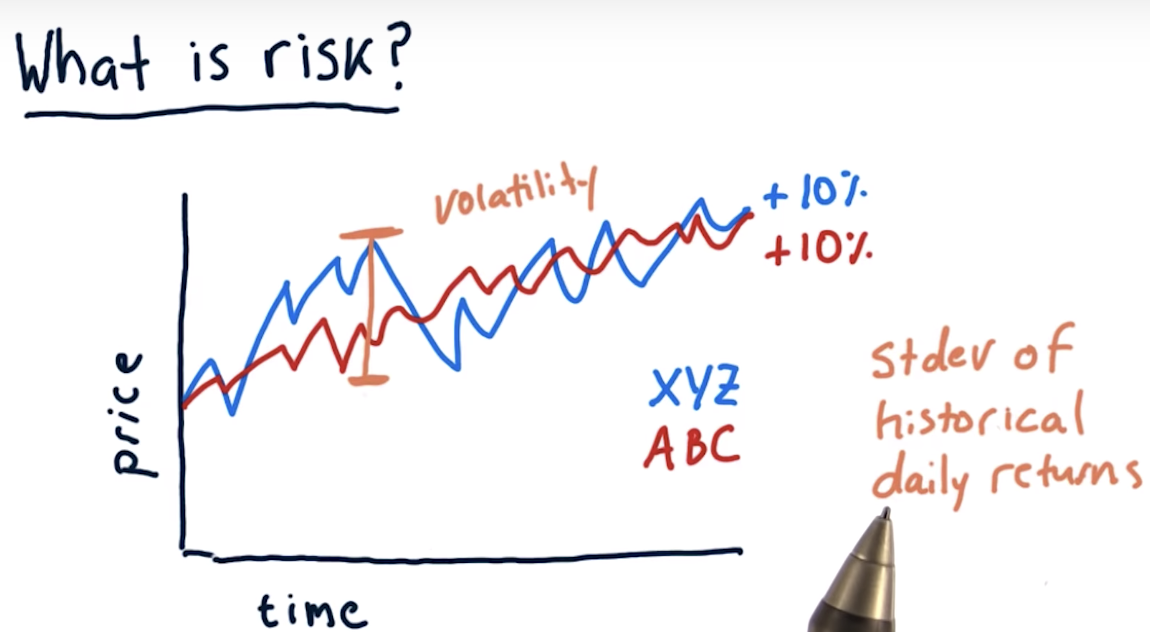

What is risk?

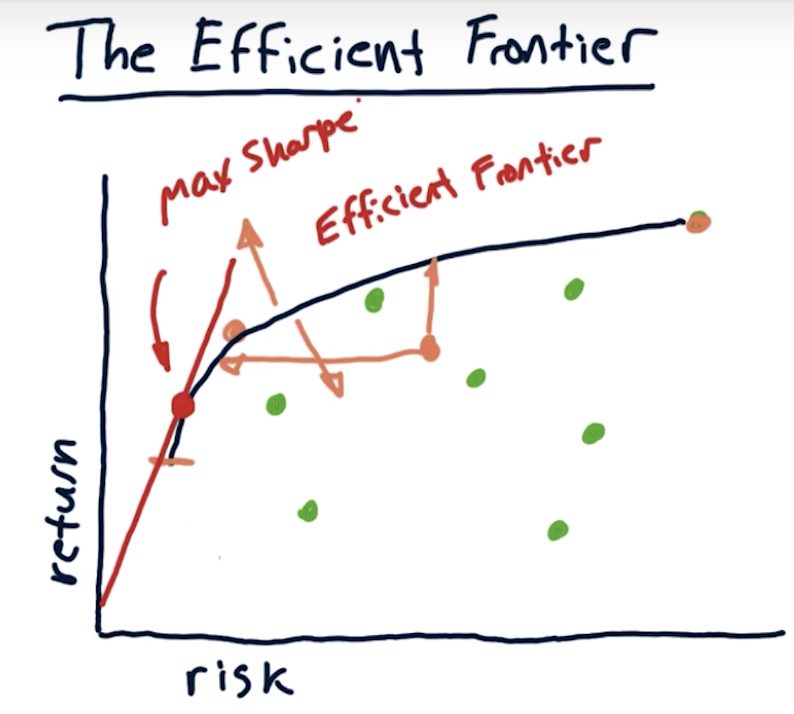

Visualizing return vs risk

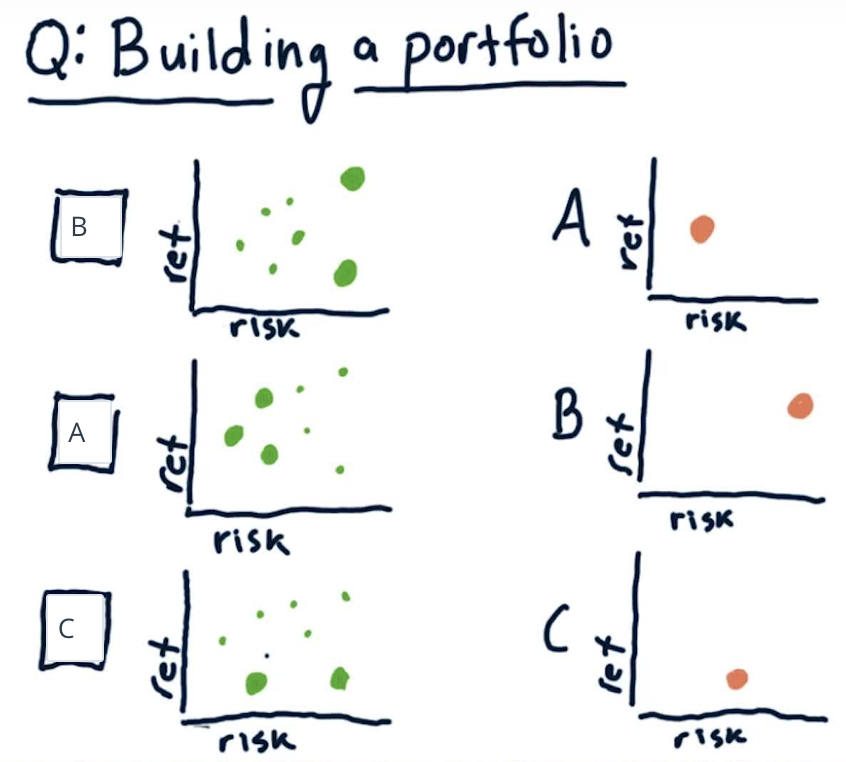

Building a portfolio

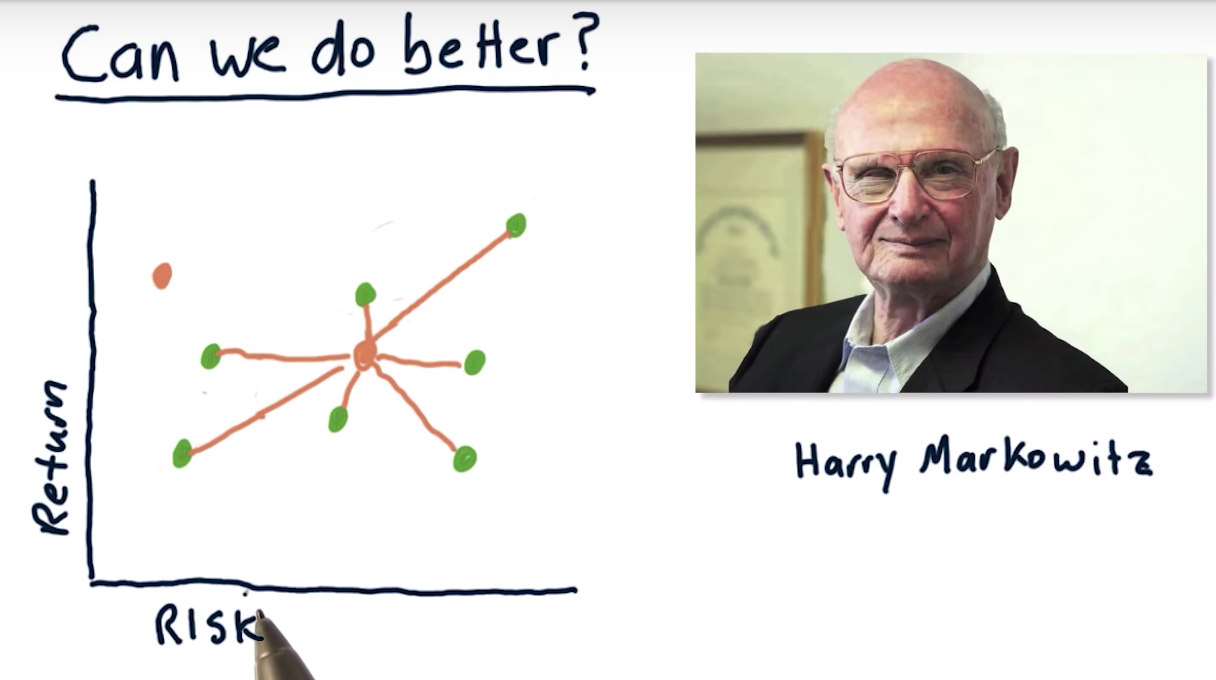

Can we do better?

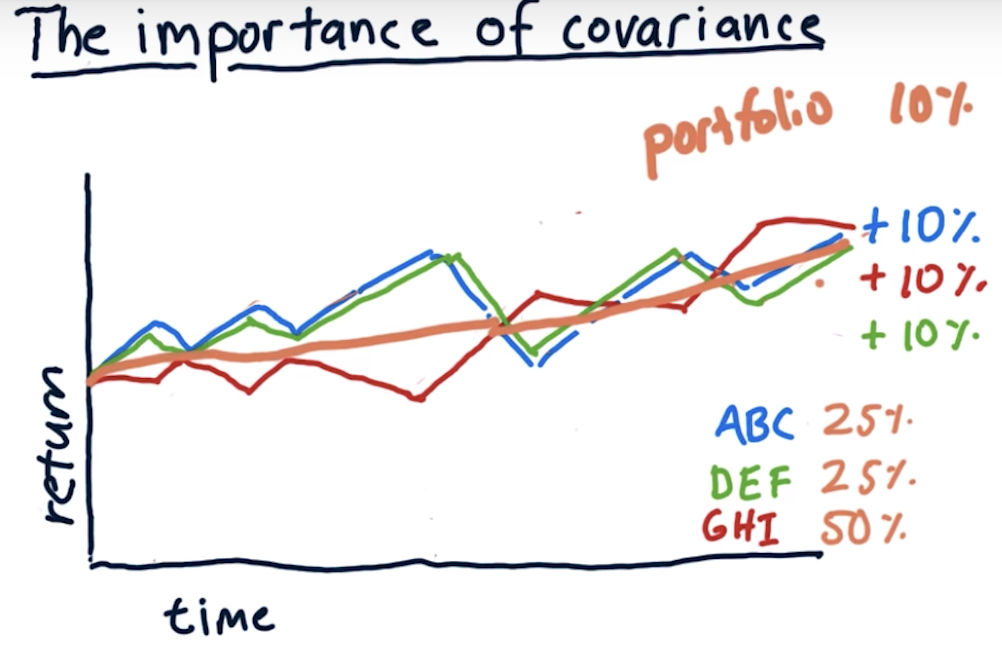

Harry discovered the relationship between stocks in terms of covariance

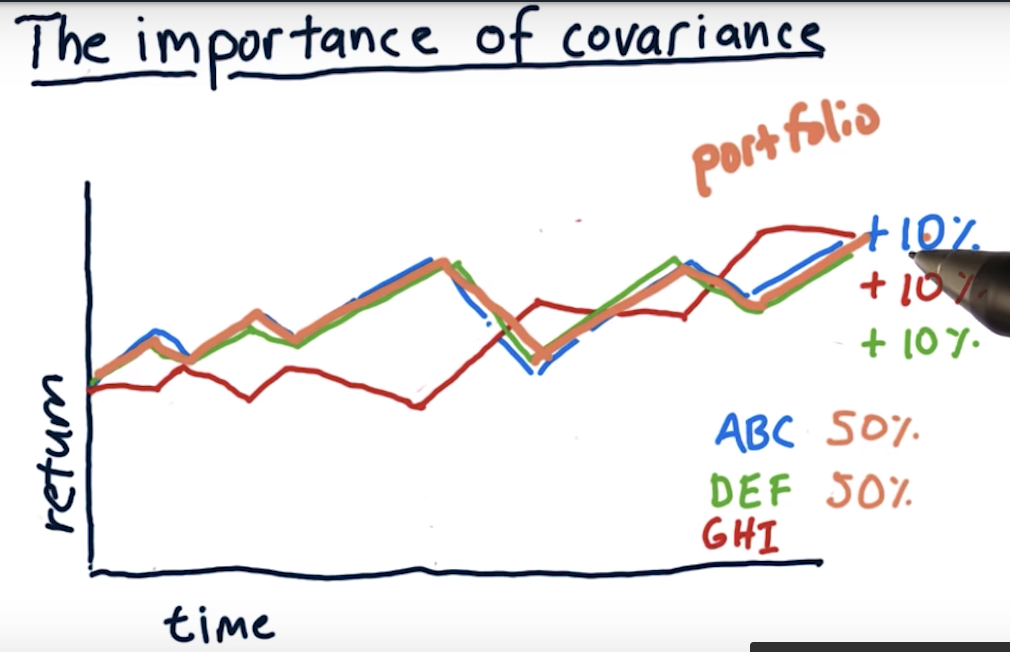

resulting of the portfolio is not just a blend of the various risks

right stocks picking => outliers

Why covariance matters

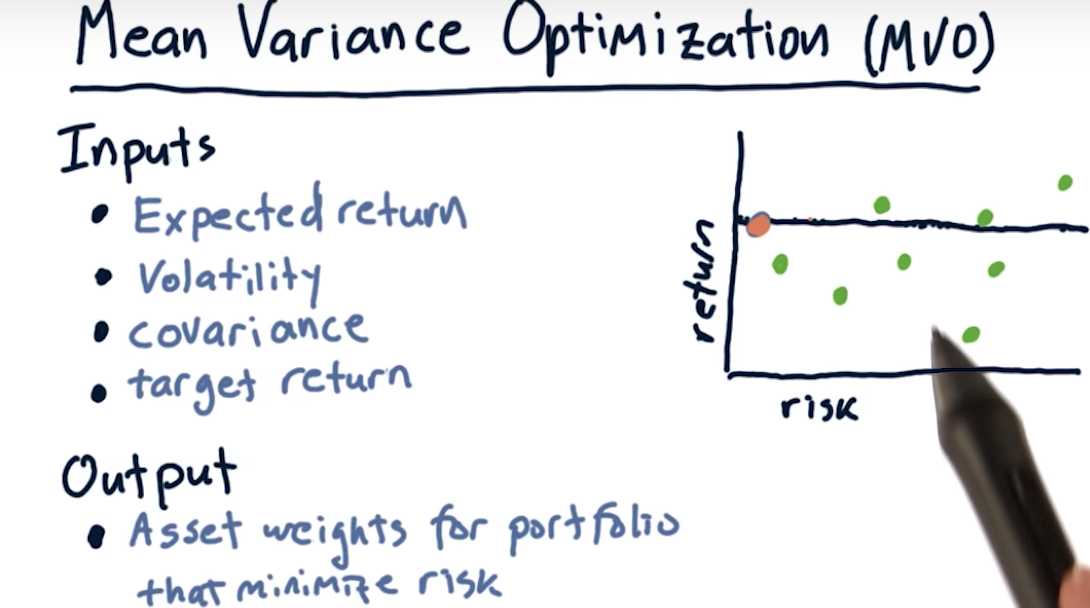

Mean Variance Optimization

The efficient frontier