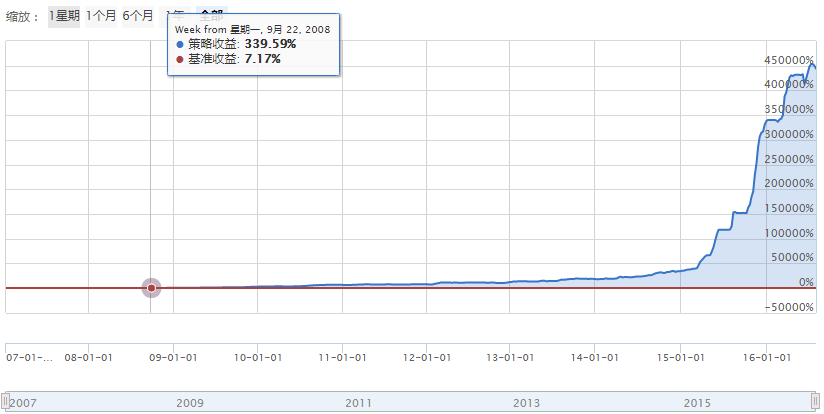

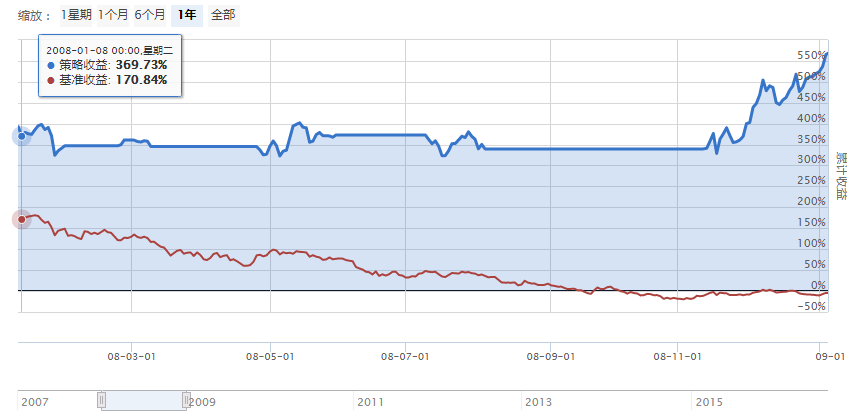

花了一天时间,根据昨天偷研究的神人账户交割单写的策略,不断调整了参数,回测测试效果惊人的可怕,从07年开始到现在年化140%.

程序回测结果:

可以说是相当恐怖了,庆幸自己可以查到如此有价值的数据,感谢FIS。

测试代码:

''' 配置指定频率的调仓日,在调仓日每日指定时间,计算沪深300指数和中证500指数当前的20日涨 幅,如果2个指数的20日涨幅有一个为正,则进行选股调仓,之后如此循环往复。 止损策略: 大盘止损: 1. 每分钟取大盘前130日的最低价和最高价,如果最高大于最低的两倍则清仓,停止交易。 2. 每分钟判断大盘是否呈现三只黑鸦止损,如果是则当天清仓并停止交易,第二天停止交 易一天。 个股止损: 每分钟判断个股是否从持仓后的最高价回撤幅度,如果超过个股回撤阈值,则平掉该股持仓 二八止损: 每日指定时间,计算沪深300指数和中证500指数当前的20日涨幅,如果2个指数涨幅都为负, 则清仓,重置调仓计数,待下次调仓条件满足再操作 ''' import tradestat #from blacklist import * # blacklist.py # 修改黑名单 # 配置股票黑名单 # 列出当且极不适宜购买的股票 # 注:1. 黑名单有时效性,回测的时候最好不使用,模拟交易建议使用 # 2. 用一模块或者大数据分析收集这类股票,定时更新 def get_blacklist(): blacklist = ["600656.XSHG","300372.XSHE","600403.XSHG","600421.XSHG","600733.XSHG","300399.XSHE", "600145.XSHG","002679.XSHE","000020.XSHE","002330.XSHE","300117.XSHE","300135.XSHE", "002566.XSHE","002119.XSHE","300208.XSHE","002237.XSHE","002608.XSHE","000691.XSHE", "002694.XSHE","002715.XSHE","002211.XSHE","000788.XSHE","300380.XSHE","300028.XSHE", "000668.XSHE","300033.XSHE","300126.XSHE","300340.XSHE","300344.XSHE","002473.XSHE"] return blacklist def before_trading_start(context): log.info("---------------------------------------------") #log.info("==> before trading start @ %s", str(context.current_dt)) # 盘前就判断三黑鸦状态,因为判断的数据为前4日 g.is_last_day_3_black_crows = is_3_black_crows(g.index_4_stop_loss_by_3_black_crows) if g.is_last_day_3_black_crows: log.info("==> 前4日已经构成三黑鸦形态") pass def after_trading_end(context): #log.info("==> after trading end @ %s", str(context.current_dt)) g.trade_stat.report(context) reset_day_param() # 得到当前未完成订单 orders = get_open_orders() for _order in orders.values(): log.info("canceled uncompleted order: %s" %(_order.order_id)) pass def initialize(context): log.info("==> initialize @ %s", str(context.current_dt)) # 设置手续费率 set_commission(PerTrade(buy_cost=0.0003, sell_cost=0.0013, min_cost=5)) # 设置基准指数:沪深300指数 '000300.XSHG' set_benchmark('000300.XSHG') # 设定滑点为百分比 # 没有调用set_slippage函数, 系统默认的滑点是PriceRelatedSlippage(0.00246) #set_slippage(PriceRelatedSlippage(0.004)) # 使用真实价格回测(模拟盘推荐如此,回测请注释) set_option('use_real_price', True) # 加载统计模块 g.trade_stat = tradestat.trade_stat() # 配置策略参数 # 此配置主要为之前的小市值策略,保证之前的收益回撤 # 如果想要更改,最好新建个函数,调整参数测试其他策略 # 10日调仓 # 关闭大盘三乌鸦及高低价止损 # 关闭个股止盈止损 # 关闭选股评分 set_param() # 缓存股票持仓后的最高价 g.last_high = {} # 如下参数不能更改 if g.is_market_stop_loss_by_price: # 记录当日是否满足大盘价格止损条件,每日盘后重置 g.is_day_stop_loss_by_price = False # 缓存三黑鸦判断状态 g.is_last_day_3_black_crows = False if g.is_market_stop_loss_by_3_black_crows: g.cur_drop_minute_count = 0 if g.is_rank_stock: if g.rank_stock_count > g.pick_stock_count: g.rank_stock_count = g.pick_stock_count if g.is_stock_stop_loss or g.is_stock_stop_profit: # 缓存当日个股250天内最大的3日涨幅,避免当日反复获取,每日盘后清空 g.pct_change = {} # 打印策略参数 log_param() def set_param(): # 调仓频率,单位:日 g.period = 3 # 调仓日计数器,单位:日 g.day_count = 0 # 配置调仓时间(24小时分钟制) g.adjust_position_hour = 14 g.adjust_position_minute = 50 # 配置选股参数 # 备选股票数目 g.pick_stock_count = 100 # 配置选股参数 # 是否根据PE选股 g.pick_by_pe = False # 如果根据PE选股,则配置最大和最小PE值 if g.pick_by_pe: g.max_pe = 200 g.min_pe = 0 # 是否根据EPS选股 g.pick_by_eps = True # 配置选股最小EPS值 if g.pick_by_eps: g.min_eps = 0 # 配置是否过滤创业板股票 g.filter_gem = True # 配置是否过滤黑名单股票,回测建议关闭,模拟运行时开启 g.filter_blacklist = True # 是否对股票评分 g.is_rank_stock = True if g.is_rank_stock: # 参与评分的股票数目 g.rank_stock_count = 20 # 买入股票数目 g.buy_stock_count = 2 # 配置二八指数 #g.index2 = '000300.XSHG' # 沪深300指数,表示二,大盘股 #g.index8 = '000905.XSHG' # 中证500指数,表示八,小盘股 g.index2 = '000016.XSHG' # 上证50指数 g.index8 = '399333.XSHE' # 中小板R指数 #g.index8 = '399006.XSHE' # 创业板指数 # 判定调仓的二八指数20日增幅 #g.index_growth_rate_20 = 0.00 g.index_growth_rate_20 = 0.01 # 配置是否根据大盘历史价格止损 # 大盘指数前130日内最高价超过最低价2倍,则清仓止损 # 注:关闭此止损,收益增加,但回撤会增加 g.is_market_stop_loss_by_price = True if g.is_market_stop_loss_by_price: # 配置价格止损判定指数,默认为上证指数,可修改为其他指数 g.index_4_stop_loss_by_price = '000001.XSHG' # 配置三黑鸦判定指数,默认为上证指数,可修改为其他指数 g.index_4_stop_loss_by_3_black_crows = '000001.XSHG' # 配置是否开启大盘三黑鸦止损 # 个人认为针对大盘判断三黑鸦效果并不好,首先有效三只乌鸦难以判断,准确率实际来看也不好, # 其次,分析历史行情看一般大盘出现三只乌鸦的时候,已经严重滞后了,使用其他止损方式可能会更好 g.is_market_stop_loss_by_3_black_crows = False if g.is_market_stop_loss_by_3_black_crows: g.dst_drop_minute_count = 10 # 配置是否个股止损 g.is_stock_stop_loss =False # 配置是否个股止盈 g.is_stock_stop_profit = False def log_param(): log.info("调仓日频率: %d日" %(g.period)) log.info("调仓时间: %s:%s" %(g.adjust_position_hour, g.adjust_position_minute)) log.info("备选股票数目: %d" %(g.pick_stock_count)) log.info("是否根据PE选股: %s" %(g.pick_by_pe)) if g.pick_by_pe: log.info("选股最大PE: %s" %(g.max_pe)) log.info("选股最小PE: %s" %(g.min_pe)) log.info("是否根据EPS选股: %s" %(g.pick_by_eps)) if g.pick_by_eps: log.info("选股最小EPS: %s" %(g.min_eps)) log.info("是否过滤创业板股票: %s" %(g.filter_gem)) log.info("是否过滤黑名单股票: %s" %(g.filter_blacklist)) if g.filter_blacklist: log.info("当前股票黑名单:%s" %str(get_blacklist())) log.info("是否对股票评分选股: %s" %(g.is_rank_stock)) if g.is_rank_stock: log.info("评分备选股票数目: %d" %(g.rank_stock_count)) log.info("买入股票数目: %d" %(g.buy_stock_count)) log.info("二八指数之二: %s - %s" %(g.index2, get_security_info(g.index2).display_name)) log.info("二八指数之八: %s - %s" %(g.index8, get_security_info(g.index8).display_name)) log.info("判定调仓的二八指数20日增幅: %.1f%%" %(g.index_growth_rate_20*100)) log.info("是否开启大盘历史高低价格止损: %s" %(g.is_market_stop_loss_by_price)) if g.is_market_stop_loss_by_price: log.info("大盘价格止损判定指数: %s - %s" %(g.index_4_stop_loss_by_price, get_security_info(g.index_4_stop_loss_by_price).display_name)) log.info("大盘三黑鸦止损判定指数: %s - %s" %(g.index_4_stop_loss_by_3_black_crows, get_security_info(g.index_4_stop_loss_by_3_black_crows).display_name)) log.info("是否开启大盘三黑鸦止损: %s" %(g.is_market_stop_loss_by_3_black_crows)) if g.is_market_stop_loss_by_3_black_crows: log.info("三黑鸦止损开启需要当日大盘为跌的分钟计数达到: %d" %(g.dst_drop_minute_count)) log.info("是否开启个股止损: %s" %(g.is_stock_stop_loss)) log.info("是否开启个股止盈: %s" %(g.is_stock_stop_profit)) # 重置当日参数,仅针对需要当日需要重置的参数 def reset_day_param(): if g.is_market_stop_loss_by_price: # 重置当日大盘价格止损状态 g.is_day_stop_loss_by_price = False if g.is_stock_stop_loss or g.is_stock_stop_profit: # 清空当日个股250天内最大的3日涨幅的缓存 g.pct_change.clear() # 重置三黑鸦状态 g.is_last_day_3_black_crows = False if g.is_market_stop_loss_by_3_black_crows: g.cur_drop_minute_count = 0 # 按分钟回测 def handle_data(context, data): if g.is_market_stop_loss_by_price: if market_stop_loss_by_price(context, g.index_4_stop_loss_by_price): return if g.is_market_stop_loss_by_3_black_crows: if market_stop_loss_by_3_black_crows(context, g.index_4_stop_loss_by_3_black_crows, g.dst_drop_minute_count): return if g.is_stock_stop_loss: stock_stop_loss(context, data) if g.is_stock_stop_profit: stock_stop_profit(context, data) # 获得当前时间 hour = context.current_dt.hour minute = context.current_dt.minute # 每天下午14:50调仓 if hour == g.adjust_position_hour and minute == g.adjust_position_minute: do_handle_data(context, data) def do_handle_data(context, data): log.info("调仓日计数 [%d]" %(g.day_count)) # 回看指数前20天的涨幅 gr_index2 = get_growth_rate(g.index2) gr_index8 = get_growth_rate(g.index8) log.info("当前%s指数的20日涨幅 [%.2f%%]" %(get_security_info(g.index2).display_name, gr_index2*100)) log.info("当前%s指数的20日涨幅 [%.2f%%]" %(get_security_info(g.index8).display_name, gr_index8*100)) if gr_index2 <= g.index_growth_rate_20 and gr_index8 <= g.index_growth_rate_20: clear_position(context) g.day_count = 0 else: #if gr_index2 > g.index_growth_rate_20 or ret_index8 > g.index_growth_rate_20: if g.day_count % g.period == 0: log.info("==> 满足条件进行调仓") buy_stocks = pick_stocks(context, data) log.info("选股后可买股票: %s" %(buy_stocks)) adjust_position(context, buy_stocks) g.day_count += 1 def market_stop_loss_by_price(context, index): # 大盘指数前130日内最高价超过最低价2倍,则清仓止损 # 基于历史数据判定,因此若状态满足,则当天都不会变化 # 增加此止损,回撤降低,收益降低 if not g.is_day_stop_loss_by_price: h = attribute_history(index, 160, unit='1d', fields=('close', 'high', 'low'), skip_paused=True) low_price_130 = h.low.min() high_price_130 = h.high.max() if high_price_130 > 2.2 * low_price_130 and h['close'][-1]<h['close'][-4]*1 and h['close'][-1]> h['close'][-100]: # 当日第一次输出日志 log.info("==> 大盘止损,%s指数前130日内最高价超过最低价2倍, 最高价: %f, 最低价: %f" %(get_security_info(index).display_name, high_price_130, low_price_130)) g.is_day_stop_loss_by_price = True if g.is_day_stop_loss_by_price: clear_position(context) g.day_count = 0 return g.is_day_stop_loss_by_price def market_stop_loss_by_3_black_crows(context, index, n): # 前日三黑鸦,累计当日每分钟涨幅<0的分钟计数 # 如果分钟计数超过一定值,则开始进行三黑鸦止损 # 避免无效三黑鸦乱止损 if g.is_last_day_3_black_crows: if get_growth_rate(index, 1) < 0: g.cur_drop_minute_count += 1 if g.cur_drop_minute_count >= n: if g.cur_drop_minute_count == n: log.info("==> 超过三黑鸦止损开始") clear_position(context) g.day_count = 0 return True return False def is_3_black_crows(stock): # talib.CDL3BLACKCROWS # 三只乌鸦说明来自百度百科 # 1. 连续出现三根阴线,每天的收盘价均低于上一日的收盘 # 2. 三根阴线前一天的市场趋势应该为上涨 # 3. 三根阴线必须为长的黑色实体,且长度应该大致相等 # 4. 收盘价接近每日的最低价位 # 5. 每日的开盘价都在上根K线的实体部分之内; # 6. 第一根阴线的实体部分,最好低于上日的最高价位 # # 算法 # 有效三只乌鸦描述众说纷纭,这里放宽条件,只考虑1和2 # 根据前4日数据判断 # 3根阴线跌幅超过4.5% h = attribute_history(stock, 4, '1d', ('close','open'), skip_paused=True, df=False) h_close = list(h['close']) h_open = list(h['open']) if len(h_close) < 4 or len(h_open) < 4: return False # 三根阴线 if h_close[-4] > h_open[-4] and (h_close[-1] < h_close[-2] and h_close[-2] < h_close[-3]) and (h_close[-1] < h_open[-1] and h_close[-2]< h_open[-2] and h_close[-3] < h_open[-3]) and h_close[-1] / h_close[-3] - 1 < -0.045 and get_current_data(stock)< h_close[-1]*0.995: return True return False ''' # 一阳三阴 if h_close[-4] > h_open[-4] and (h_close[-1] < h_open[-1] and h_close[-2]< h_open[-2] and h_close[-3] < h_open[-3]): #and (h_close[-1] < h_close[-2] and h_close[-2] < h_close[-3]) #and h_close[-1] / h_close[-3] - 1 < -0.045: return True return False ''' ''' def is_3_black_crows(stock, data): # talib.CDL3BLACKCROWS his = attribute_history(stock, 2, '1d', ('close','open'), skip_paused=True, df=False) closeArray = list(his['close']) closeArray.append(data[stock].close) openArray = list(his['open']) openArray.append(get_current_data()[stock].day_open) if closeArray[0]<openArray[0] and closeArray[1]<openArray[1] and closeArray[2]<openArray[2]: if closeArray[-1]/closeArray[0]-1>-0.045: his2 = attribute_history(stock, 4, '1d', ('close','open'), skip_paused=True, df=False) closeArray1 = his2['close'] if closeArray[0]/closeArray1[0]-1>0: return True return False ''' # 个股止损 def stock_stop_loss(context, data): for stock in context.portfolio.positions.keys(): cur_price = data[stock].close xi = attribute_history(stock, 2, '1d', 'high', skip_paused=True) ma = xi.max() if g.last_high[stock] < cur_price: g.last_high[stock] = cur_price threshold = get_stop_loss_threshold(stock, g.period) #log.debug("个股止损阈值, stock: %s, threshold: %f" %(stock, threshold)) if cur_price < g.last_high[stock] * (1 - threshold): log.info("==> 个股止损, stock: %s, cur_price: %f, last_high: %f, threshold: %f" %(stock, cur_price, g.last_high[stock], threshold)) position = context.portfolio.positions[stock] if close_position(position): g.day_count = 0 # 个股止盈 def stock_stop_profit(context, data): for stock in context.portfolio.positions.keys(): position = context.portfolio.positions[stock] cur_price = data[stock].close threshold = get_stop_profit_threshold(stock, g.period) #log.debug("个股止盈阈值, stock: %s, threshold: %f" %(stock, threshold)) if cur_price > position.avg_cost * (1 + threshold): log.info("==> 个股止盈, stock: %s, cur_price: %f, avg_cost: %f, threshold: %f" %(stock, cur_price, g.last_high[stock], threshold)) position = context.portfolio.positions[stock] if close_position(position): g.day_count = 0 # 获取个股前n天的m日增幅值序列 # 增加缓存避免当日多次获取数据 def get_pct_change(security, n, m): pct_change = None if security in g.pct_change.keys(): pct_change = g.pct_change[security] else: h = attribute_history(security, n, unit='1d', fields=('close'), skip_paused=True) pct_change = h['close'].pct_change(m) # 3日的百分比变比(即3日涨跌幅) g.pct_change[security] = pct_change return pct_change # 计算个股回撤止损阈值 # 即个股在持仓n天内能承受的最大跌幅 # 算法:(个股250天内最大的n日跌幅 + 个股250天内平均的n日跌幅)/2 # 返回正值 def get_stop_loss_threshold(security, n = 3): pct_change = get_pct_change(security, 250, n) #log.debug("pct of security [%s]: %s", pct) maxd = pct_change.min() #maxd = pct[pct<0].min() avgd = pct_change.mean() #avgd = pct[pct<0].mean() # maxd和avgd可能为正,表示这段时间内一直在增长,比如新股 bstd = (maxd + avgd) / 2 # 数据不足时,计算的bstd为nan if not isnan(bstd): if bstd != 0: return abs(bstd) else: # bstd = 0,则 maxd <= 0 if maxd < 0: # 此时取最大跌幅 return abs(maxd) return 0.099 # 默认配置回测止损阈值最大跌幅为-9.9%,阈值高貌似回撤降低 # 计算个股止盈阈值 # 算法:个股250天内最大的n日涨幅 # 返回正值 def get_stop_profit_threshold(security, n = 3): pct_change = get_pct_change(security, 250, n) maxr = pct_change.max() # 数据不足时,计算的maxr为nan # 理论上maxr可能为负 if (not isnan(maxr)) and maxr != 0: return abs(maxr) return 0.30 # 默认配置止盈阈值最大涨幅为20% # 获取股票n日以来涨幅,根据当前价计算 # n 默认20日 def get_growth_rate(security, n=20): lc = get_close_price(security, n) #c = data[security].close c = get_close_price(security, 1, '1m') if not isnan(lc) and not isnan(c) and lc != 0: return (c - lc) / lc else: log.error("数据非法, security: %s, %d日收盘价: %f, 当前价: %f" %(security, n, lc, c)) return 0 # 获取前n个单位时间当时的收盘价 def get_close_price(security, n, unit='1d'): return attribute_history(security, n, unit, ('close'), True)['close'][0] # 开仓,买入指定价值的证券 # 报单成功并成交(包括全部成交或部分成交,此时成交量大于0),返回True # 报单失败或者报单成功但被取消(此时成交量等于0),返回False def open_position(security, value): order = order_target_value_(security, value) if order != None and order.filled > 0: # 报单成功并有成交则初始化最高价 cur_price = get_close_price(security, 1, '1m') g.last_high[security] = cur_price return True return False # 平仓,卖出指定持仓 # 平仓成功并全部成交,返回True # 报单失败或者报单成功但被取消(此时成交量等于0),或者报单非全部成交,返回False def close_position(position): security = position.security order = order_target_value_(security, 0) # 可能会因停牌失败 if order != None: if order.filled > 0: # 只要有成交,无论全部成交还是部分成交,则统计盈亏 g.trade_stat.watch(security, order.filled, position.avg_cost, position.price) if order.status == OrderStatus.held and order.filled == order.amount: # 全部成交则删除相关证券的最高价缓存 if security in g.last_high: g.last_high.pop(security) else: log.warn("last high price of %s not found" %(security)) return True return False # 清空卖出所有持仓 def clear_position(context): if context.portfolio.positions: log.info("==> 清仓,卖出所有股票") for stock in context.portfolio.positions.keys(): position = context.portfolio.positions[stock] close_position(position) # 自定义下单 # 根据Joinquant文档,当前报单函数都是阻塞执行,报单函数(如order_target_value)返回即表示报单完成 # 报单成功返回报单(不代表一定会成交),否则返回None def order_target_value_(security, value): if value == 0: log.debug("Selling out %s" % (security)) else: log.debug("Order %s to value %f" % (security, value)) # 如果股票停牌,创建报单会失败,order_target_value 返回None # 如果股票涨跌停,创建报单会成功,order_target_value 返回Order,但是报单会取消 # 部成部撤的报单,聚宽状态是已撤,此时成交量>0,可通过成交量判断是否有成交 return order_target_value(security, value) # 过滤停牌股票 def filter_paused_stock(stock_list): current_data = get_current_data() return [stock for stock in stock_list if not current_data[stock].paused] # 过滤ST及其他具有退市标签的股票 def filter_st_stock(stock_list): current_data = get_current_data() return [stock for stock in stock_list if not current_data[stock].is_st and 'ST' not in current_data[stock].name and '*' not in current_data[stock].name and '退' not in current_data[stock].name] # 过滤涨停的股票 def filter_limitup_stock(context, stock_list): last_prices = history(1, unit='1m', field='close', security_list=stock_list) current_data = get_current_data() # 已存在于持仓的股票即使涨停也不过滤,避免此股票再次可买,但因被过滤而导致选择别的股票 return [stock for stock in stock_list if stock in context.portfolio.positions.keys() or last_prices[stock][-1] < current_data[stock].high_limit] #return [stock for stock in stock_list if stock in context.portfolio.positions.keys() # or last_prices[stock][-1] < current_data[stock].high_limit * 0.995] # 过滤跌停的股票 def filter_limitdown_stock(context, stock_list): last_prices = history(1, unit='1m', field='close', security_list=stock_list) current_data = get_current_data() return [stock for stock in stock_list if stock in context.portfolio.positions.keys() or last_prices[stock][-1] > current_data[stock].low_limit] #return [stock for stock in stock_list if last_prices[stock][-1] > current_data[stock].low_limit] #return [stock for stock in stock_list if stock in context.portfolio.positions.keys() # or last_prices[stock][-1] > current_data[stock].low_limit * 1.005] # 过滤黑名单股票 def filter_blacklist_stock(context, stock_list): blacklist = get_blacklist() return [stock for stock in stock_list if stock not in blacklist] # 过滤创业版股票 def filter_gem_stock(context, stock_list): return [stock for stock in stock_list if stock[0:3] != '300'] # 过滤20日增长率为负的股票 def filter_by_growth_rate(stock_list, n): return [stock for stock in stock_list if get_growth_rate(stock, n) > 0] # 股票评分 def rank_stocks(data, stock_list): dst_stocks = {} for stock in stock_list: h = attribute_history(stock, 130, unit='1d', fields=('close', 'high', 'low'), skip_paused=True) low_price_130 = h.low.min() high_price_130 = h.high.max() avg_15 = data[stock].mavg(15, field='close') cur_price = data[stock].close #avg_15 = h['close'][-15:].mean() #cur_price = get_close_price(stock, 1, '1m') score = (cur_price-low_price_130) + (cur_price-high_price_130) + (cur_price-avg_15) #score = ((cur_price-low_price_130) + (cur_price-high_price_130) + (cur_price-avg_15)) / cur_price dst_stocks[stock] = score df = pd.DataFrame(dst_stocks.values(), index=dst_stocks.keys()) df.columns = ['score'] df = df.sort(columns='score', ascending=True) return df.index ''' # 过滤新股 def filter_new_stock(stock_list): stocks = get_all_securities(['stock']) stocks = stocks[(context.current_dt.date() - stocks.start_date) > datetime.timedelta(60)].index ''' # 选股 # 选取指定数目的小市值股票,再进行过滤,最终挑选指定可买数目的股票 def pick_stocks(context, data): q = None if g.pick_by_pe: if g.pick_by_eps: q = query(valuation.code).filter( indicator.eps > g.min_eps, valuation.pe_ratio > g.min_pe, valuation.pe_ratio < g.max_pe ).order_by( valuation.market_cap.asc() ).limit( g.pick_stock_count ) else: q = query(valuation.code).filter( valuation.pe_ratio > g.min_pe, valuation.pe_ratio < g.max_pe ).order_by( valuation.market_cap.asc() ).limit( g.pick_stock_count ) else: if g.pick_by_eps: q = query(valuation.code).filter( indicator.eps > g.min_eps ).order_by( valuation.market_cap.asc() ).limit( g.pick_stock_count ) else: q = query(valuation.code).order_by( valuation.market_cap.asc() ).limit( g.pick_stock_count ) df = get_fundamentals(q) stock_list = list(df['code']) if g.filter_gem: stock_list = filter_gem_stock(context, stock_list) if g.filter_blacklist: stock_list = filter_blacklist_stock(context, stock_list) stock_list = filter_paused_stock(stock_list) stock_list = filter_st_stock(stock_list) stock_list = filter_limitup_stock(context, stock_list) stock_list = filter_limitdown_stock(context, stock_list) # 根据20日股票涨幅过滤效果不好,故注释 #stock_list = filter_by_growth_rate(stock_list, 15) if g.is_rank_stock: if len(stock_list) > g.rank_stock_count: stock_list = stock_list[:g.rank_stock_count] #log.debug("评分前备选股票: %s" %(stock_list)) if len(stock_list) > 0: stock_list = rank_stocks(data, stock_list) #log.debug("评分后备选股票: %s" %(stock_list)) # 选取指定可买数目的股票 if len(stock_list) > g.buy_stock_count: stock_list = stock_list[:g.buy_stock_count] return stock_list # 根据待买股票创建或调整仓位 # 对于因停牌等原因没有卖出的股票则继续持有 # 始终保持持仓数目为g.buy_stock_count def adjust_position(context, buy_stocks): for stock in context.portfolio.positions.keys(): if stock not in buy_stocks: log.info("stock [%s] in position is not buyable" %(stock)) position = context.portfolio.positions[stock] close_position(position) else: log.info("stock [%s] is already in position" %(stock)) # 根据股票数量分仓 # 此处只根据可用金额平均分配购买,不能保证每个仓位平均分配 position_count = len(context.portfolio.positions) if g.buy_stock_count > position_count: value = context.portfolio.cash / (g.buy_stock_count - position_count) for stock in buy_stocks: if context.portfolio.positions[stock].total_amount == 0: if open_position(stock, value): if len(context.portfolio.positions) == g.buy_stock_count: break