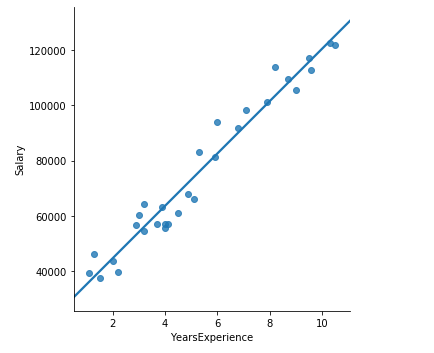

# 工作年限与收入之间的散点图

# 导入第三方模块

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

# 导入数据集

income = pd.read_csv(r'F:\python_Data_analysis_and_mining\07\Salary_Data.csv')

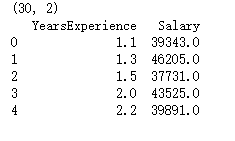

print(income.shape)

print(income.head())

# 绘制散点图

sns.lmplot(x = 'YearsExperience', y = 'Salary', data = income, ci = None)

# 显示图形

plt.show()

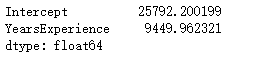

# 简单线性回归模型的参数求解

# 样本量

n = income.shape[0]

# 计算自变量、因变量、自变量平方、自变量与因变量乘积的和

sum_x = income.YearsExperience.sum()

sum_y = income.Salary.sum()

sum_x2 = income.YearsExperience.pow(2).sum()

xy = income.YearsExperience * income.Salary

sum_xy = xy.sum()

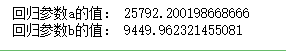

# 根据公式计算回归模型的参数

b = (sum_xy-sum_x*sum_y/n)/(sum_x2-sum_x**2/n)

a = income.Salary.mean()-b*income.YearsExperience.mean()

# 打印出计算结果

print('回归参数a的值:',a)

print('回归参数b的值:',b)

# 导入第三方模块

import statsmodels.api as sm

# 利用收入数据集,构建回归模型

fit = sm.formula.ols('Salary ~ YearsExperience', data = income).fit()

# 返回模型的参数值

print(fit.params)

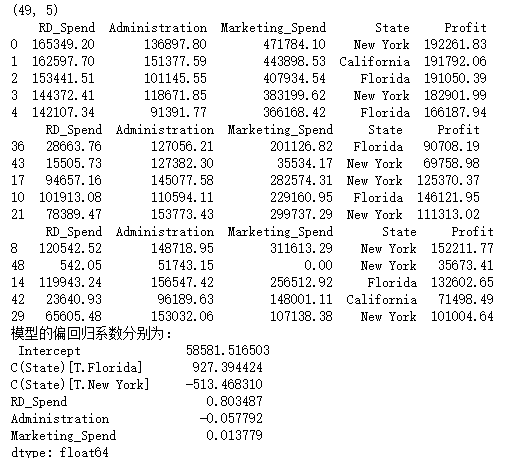

# 多元线性回归模型的构建和预测

# 导入模块

from sklearn import model_selection

# 导入数据

Profit = pd.read_excel(r'F:\python_Data_analysis_and_mining\07\Predict to Profit.xlsx')

print(Profit.shape)

print(Profit.head())

# 将数据集拆分为训练集和测试集

train, test = model_selection.train_test_split(Profit, test_size = 0.2, random_state=1234)

print(train.head())

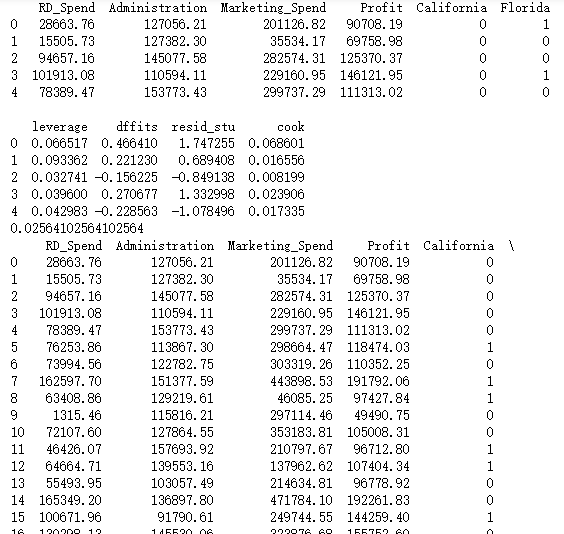

print(test.head())

# 根据train数据集建模

model = sm.formula.ols('Profit ~ RD_Spend + Administration + Marketing_Spend + C(State)', data = train).fit()

print('模型的偏回归系数分别为:

', model.params)

# 删除test数据集中的Profit变量,用剩下的自变量进行预测

test_X = test.drop(labels = 'Profit', axis = 1)

pred = model.predict(exog = test_X)

print('对比预测值和实际值的差异:

',pd.DataFrame({'Prediction':pred,'Real':test.Profit}))

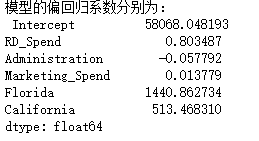

# 生成由State变量衍生的哑变量

dummies = pd.get_dummies(Profit.State)

# 将哑变量与原始数据集水平合并

Profit_New = pd.concat([Profit,dummies], axis = 1)

print(Profit_New.shape)

print(Profit_New.head())

# 删除State变量和California变量(因为State变量已被分解为哑变量,New York变量需要作为参照组)

Profit_New.drop(labels = ['State','New York'], axis = 1, inplace = True)

# 拆分数据集Profit_New

train, test = model_selection.train_test_split(Profit_New, test_size = 0.2, random_state=1234)

# 建模

model2 = sm.formula.ols('Profit ~ RD_Spend + Administration + Marketing_Spend + Florida + California', data = train).fit()

print('模型的偏回归系数分别为:

', model2.params)

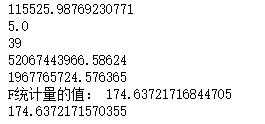

# 导入第三方模块

import numpy as np

# 计算建模数据中,因变量的均值

ybar = train.Profit.mean()

print(ybar)

# 统计变量个数和观测个数

p = model2.df_model

print(p)

n = train.shape[0]

print(n)

# 计算回归离差平方和

RSS = np.sum((model2.fittedvalues-ybar) ** 2)

print(RSS)

# 计算误差平方和

ESS = np.sum(model2.resid ** 2)

print(ESS)

# 计算F统计量的值

F = (RSS/p)/(ESS/(n-p-1))

print('F统计量的值:',F)

# 返回模型中的F值

print(model2.fvalue)

# 导入模块

from scipy.stats import f

# 计算F分布的理论值

F_Theroy = f.ppf(q=0.95, dfn = p,dfd = n-p-1)

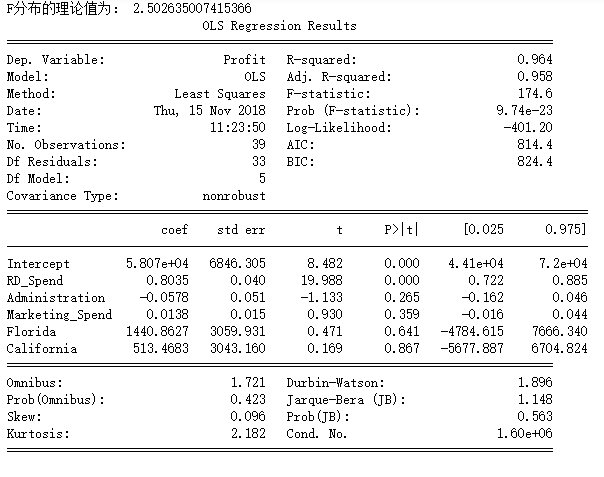

print('F分布的理论值为:',F_Theroy)

# 模型的概览信息

print(model2.summary())

# 正态性检验

# 直方图法

# 导入第三方模块

import scipy.stats as stats

# 中文和负号的正常显示

plt.rcParams['font.sans-serif'] = ['Microsoft YaHei']

plt.rcParams['axes.unicode_minus'] = False

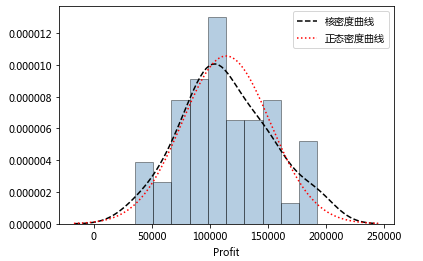

# 绘制直方图

sns.distplot(a = Profit_New.Profit, bins = 10, fit = stats.norm, norm_hist = True,

hist_kws = {'color':'steelblue', 'edgecolor':'black'},

kde_kws = {'color':'black', 'linestyle':'--', 'label':'核密度曲线'},

fit_kws = {'color':'red', 'linestyle':':', 'label':'正态密度曲线'})

# 显示图例

plt.legend()

# 显示图形

plt.show()

# 残差的正态性检验(PP图和QQ图法)

pp_qq_plot = sm.ProbPlot(Profit_New.Profit)

# 绘制PP图

pp_qq_plot.ppplot(line = '45')

plt.title('P-P图')

# 绘制QQ图

pp_qq_plot.qqplot(line = 'q')

plt.title('Q-Q图')

# 显示图形

plt.show()

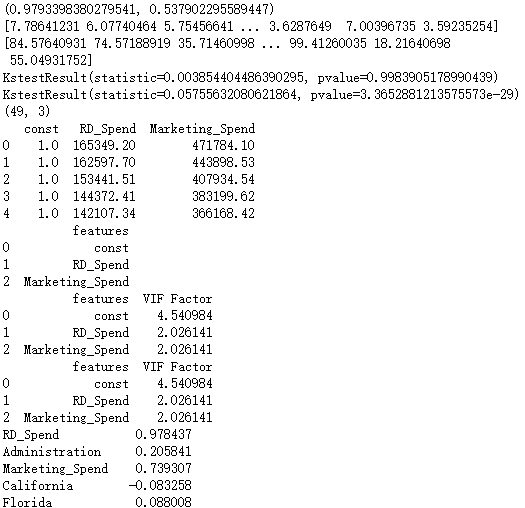

# 导入模块

import scipy.stats as stats

a = stats.shapiro(Profit_New.Profit)

print(a)

# 生成正态分布和均匀分布随机数

rnorm = np.random.normal(loc = 5, scale=2, size = 10000)

print(rnorm)

runif = np.random.uniform(low = 1, high = 100, size = 10000)

print(runif)

# 正态性检验

KS_Test1 = stats.kstest(rvs = rnorm, args = (rnorm.mean(), rnorm.std()), cdf = 'norm')

print(KS_Test1)

KS_Test2 = stats.kstest(rvs = runif, args = (runif.mean(), runif.std()), cdf = 'norm')

print(KS_Test2)

# 导入statsmodels模块中的函数

from statsmodels.stats.outliers_influence import variance_inflation_factor

# 自变量X(包含RD_Spend、Marketing_Spend和常数列1)

X = sm.add_constant(Profit_New.ix[:,['RD_Spend','Marketing_Spend']])

print(X.shape)

print(X.head())

# 构造空的数据框,用于存储VIF值

vif = pd.DataFrame()

vif["features"] = X.columns

print(vif)

vif["VIF Factor"] = [variance_inflation_factor(X.values, i) for i in range(X.shape[1])]

print(vif)

# 返回VIF值

print(vif)

# 计算数据集Profit_New中每个自变量与因变量利润之间的相关系数

a = Profit_New.drop('Profit', axis = 1).corrwith(Profit_New.Profit)

print(a)

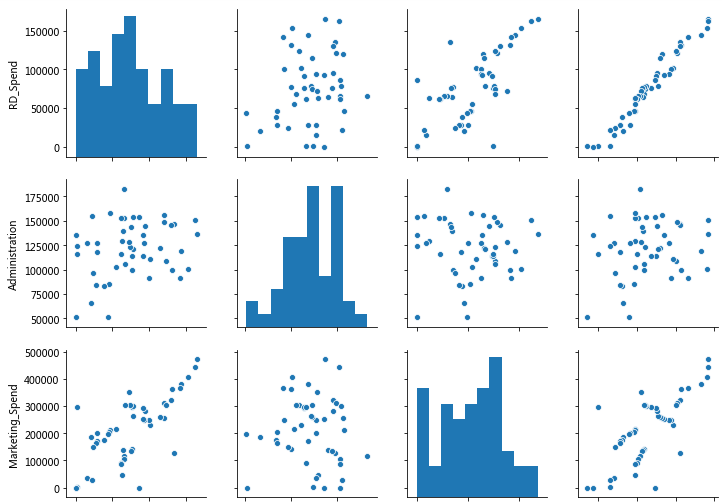

# 散点图矩阵

# 导入模块

import matplotlib.pyplot as plt

import seaborn

# 绘制散点图矩阵

seaborn.pairplot(Profit_New.ix[:,['RD_Spend','Administration','Marketing_Spend','Profit']])

# 显示图形

plt.show()

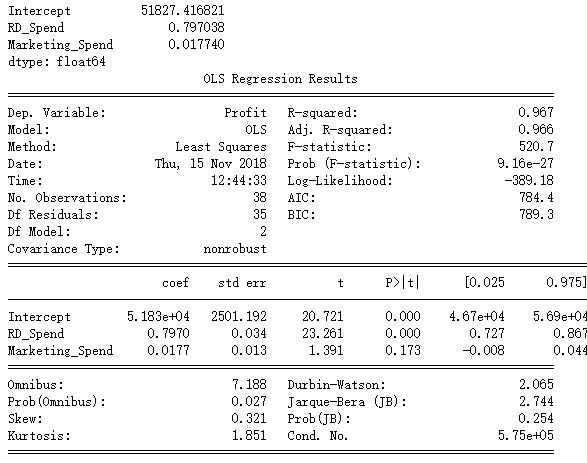

import statsmodels.formula.api as smf

# 模型修正

model3 = smf.ols('Profit ~ RD_Spend + Marketing_Spend', data = train).fit()

# 模型回归系数的估计值

print(model3.params)

# 异常值检验

outliers = model3.get_influence()

print(outliers)

# 高杠杆值点(帽子矩阵)

leverage = outliers.hat_matrix_diag

print(leverage)

# dffits值

dffits = outliers.dffits[0]

print(dffits)

# 学生化残差

resid_stu = outliers.resid_studentized_external

print(resid_stu)

# cook距离

cook = outliers.cooks_distance[0]

print(cook)

# 合并各种异常值检验的统计量值

contat1 = pd.concat([pd.Series(leverage, name = 'leverage'),pd.Series(dffits, name = 'dffits'),

pd.Series(resid_stu,name = 'resid_stu'),pd.Series(cook, name = 'cook')],axis = 1)

print(contat1)

# 重设train数据的行索引

train.index = range(train.shape[0])

# 将上面的统计量与train数据集合并

profit_outliers = pd.concat([train,contat1], axis = 1)

print(profit_outliers.head())

# 计算异常值数量的比例

outliers_ratio = sum(np.where((np.abs(profit_outliers.resid_stu)>2),1,0))/profit_outliers.shape[0]

print(outliers_ratio)

# 挑选出非异常的观测点

none_outliers = profit_outliers.ix[np.abs(profit_outliers.resid_stu)<=2,]

print(none_outliers)

# 应用无异常值的数据集重新建模

model4 = smf.ols('Profit ~ RD_Spend + Marketing_Spend', data = none_outliers).fit()

print(model4.params)

# Durbin-Watson统计量

# 模型概览

print(model4.summary())

# 方差齐性检验

# 设置第一张子图的位置

ax1 = plt.subplot2grid(shape = (2,1), loc = (0,0))

# 绘制散点图

ax1.scatter(none_outliers.RD_Spend, (model4.resid-model4.resid.mean())/model4.resid.std())

# 添加水平参考线

ax1.hlines(y = 0 ,xmin = none_outliers.RD_Spend.min(),xmax = none_outliers.RD_Spend.max(), color = 'red', linestyles = '--')

# 添加x轴和y轴标签

ax1.set_xlabel('RD_Spend')

ax1.set_ylabel('Std_Residual')

# 设置第二张子图的位置

ax2 = plt.subplot2grid(shape = (2,1), loc = (1,0))

# 绘制散点图

ax2.scatter(none_outliers.Marketing_Spend, (model4.resid-model4.resid.mean())/model4.resid.std())

# 添加水平参考线

ax2.hlines(y = 0 ,xmin = none_outliers.Marketing_Spend.min(),xmax = none_outliers.Marketing_Spend.max(), color = 'red', linestyles = '--')

# 添加x轴和y轴标签

ax2.set_xlabel('Marketing_Spend')

ax2.set_ylabel('Std_Residual')

# 调整子图之间的水平间距和高度间距

plt.subplots_adjust(hspace=0.6, wspace=0.3)

# 显示图形

plt.show()

# BP检验

sm.stats.diagnostic.het_breushpagan(model4.resid, exog_het = model4.model.exog)

# 模型预测

# model4对测试集的预测

pred4 = model4.predict(exog = test.ix[:,['RD_Spend','Marketing_Spend']])

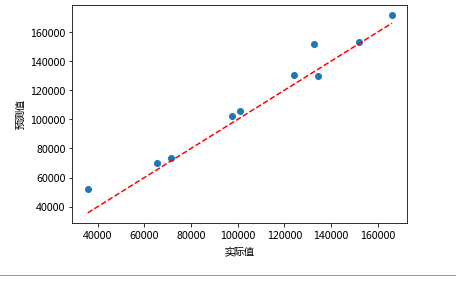

# 绘制预测值与实际值的散点图

plt.scatter(x = test.Profit, y = pred4)

# 添加斜率为1,截距项为0的参考线

plt.plot([test.Profit.min(),test.Profit.max()],[test.Profit.min(),test.Profit.max()],

color = 'red', linestyle = '--')

# 添加轴标签

plt.xlabel('实际值')

plt.ylabel('预测值')

# 显示图形

plt.show()