Chaptor 1 Basic economics concepts

1.1 introduction to economics

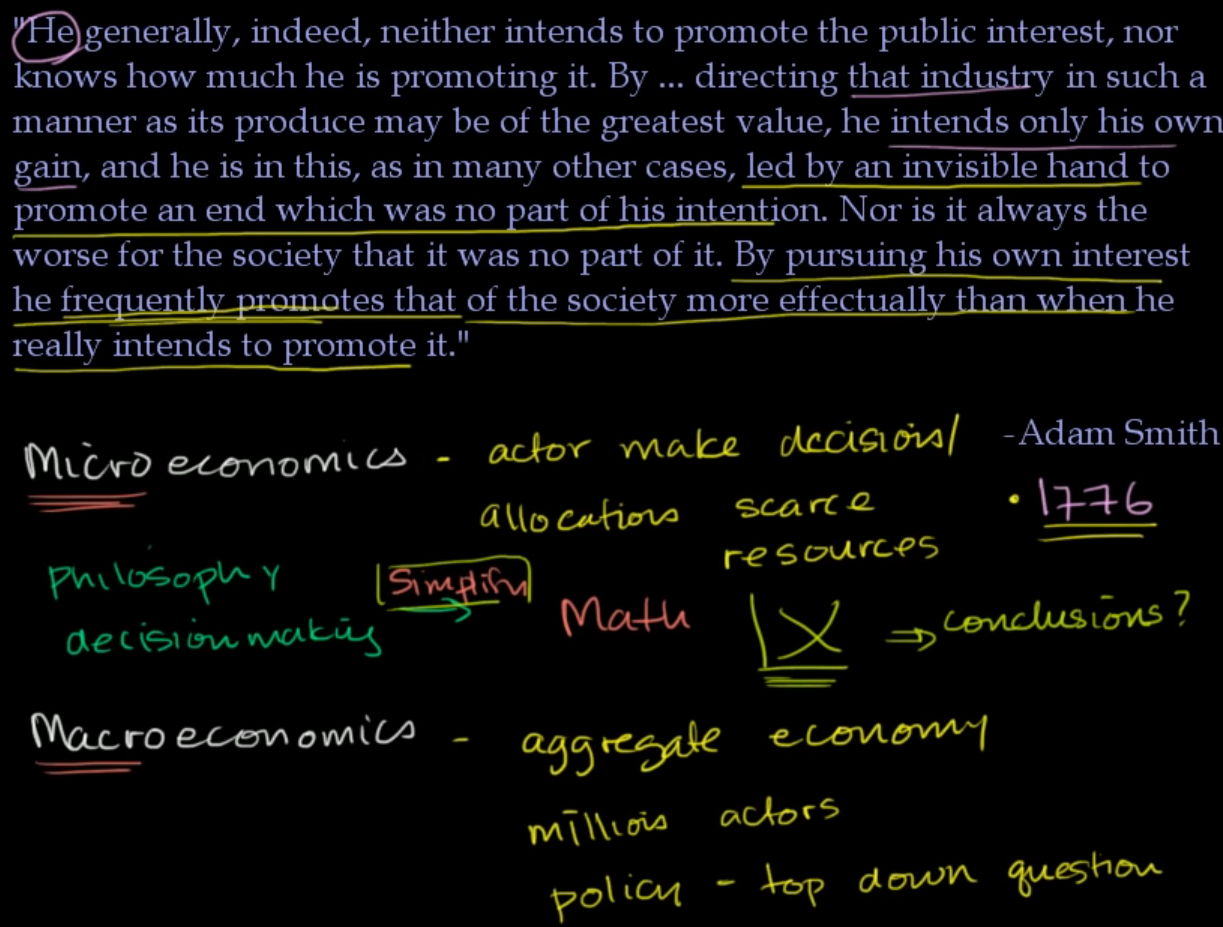

modern economists tend to divide themselves into these two subjects: microeconomics, which is the study of individual actors. And those actors could be firms, could be people, it could be households. And you have macro-economics, which is the study of the economy in aggregate. And you get it from the words. Micro -- the prefix refers to very small things. Macro refers to the larger, to the bigger picture. And so, micro-economics is essentially how actors make decisions or allocations of scarce resources.

And you hear the words scarce resources a lot when people talk about economics. And a scarce resource is one you don't have an infinite amount of. For example, love might not be a scarce resource. You might have an infinite amount of love. But a resource that would be scarce is something like food, or water, or money, or time, or labor. These are all scarce resources. And so microeconomics is how do people decide where to put those scarce resource, how do they decide where to deploy them. And how does that .. does that affect prices and markets, and whatever else.

Macro-economics is the study of what happens at the aggregate to an economy. We now have millions of actors. And often focuses on policy-related questions. SO, do you raise or lower taxes. Or, what's going to happen when you raise or lower taxes. Do you regulate or de-regulate? How does that affect the overall productivity when you do this. So, it's policy, top-down .. 'top-down' questions.And in both macro- and micro-economics, there is especially in the modern sense of it, there is an attempt to make them rigorous, to make them mathematical. So, in either case you could start with some of the ideas, some of the philosophical ideas, so of the logical ideas, to say someone like Adam Smith might have. So, you have these basic ideas about how people think, how people make decisions.

'philosophy' of people, of decision-making, in the case of micro-economics -- 'decision-making' And then you make some assumptions about it. "all people are gonna act in their own self-interest, or all people are going to maximize their gain", which isn't true -- human beings are motivated by a whole bunch of things. We simplify things, so we can start to deal with it kind of a mathematical way. SO you simplify it, so you can start dealing with it in a mathematical sense. So, this is valuable to clarify your thinking. It can allow you to prove things based on your assumptions. And so, you can start to visualize things mathematically, with charts and graphs and think about what would actually happen with markets. But at the same time, it could be a little bit dangerous, because you are making these huge simplifications, and sometimes the math might lead you to some very strong conclusions. Conclusions, which you might feel very strongly about, because it looks like you've proven them in the same way that you might prove relativity, but they were based on some assumptions that either might be wrong, or might be over-simplifications, or might not be relevant to the context that you're trying to make conclusions about.

So it's very very very important to take it all with a grain of salt, to remember that it's all based on some simplifying assumption. In micro-economics you are taking these deeply complicated things that are the human brain, how people act and respond to each other, and then you are aggregating it over millions of people, so it's ultra-complicated. You've millions of these infinitely complicated people, all interacting with each other. SO, it's very complicated. Many millions of interactions, and fundamentally unpredictable interactions, and then trying to make assumptions on those, trying to make assumptions and then doing math with that -- that could lead you to some conclusions or might be leading you to some predictions.

1. 2 Scarcity

The entire field of economics is based on the idea of scarcity. So what does scarcity mean? It means that there's not enough of something to go around. If we're talking about scarce goods, scarce services, scarce resources, we're talking about things where if there was no cost associated with them, people would use far more of that than there actually is around. So a related idea to scarce resources is it's opposite, which is the notion of a free resource. So this is something that, you could argue, is infinitely abundant or at least in a certain context is so abundant that it feels like people can have as much of it as they want.

1. 3. Normative and positive statements

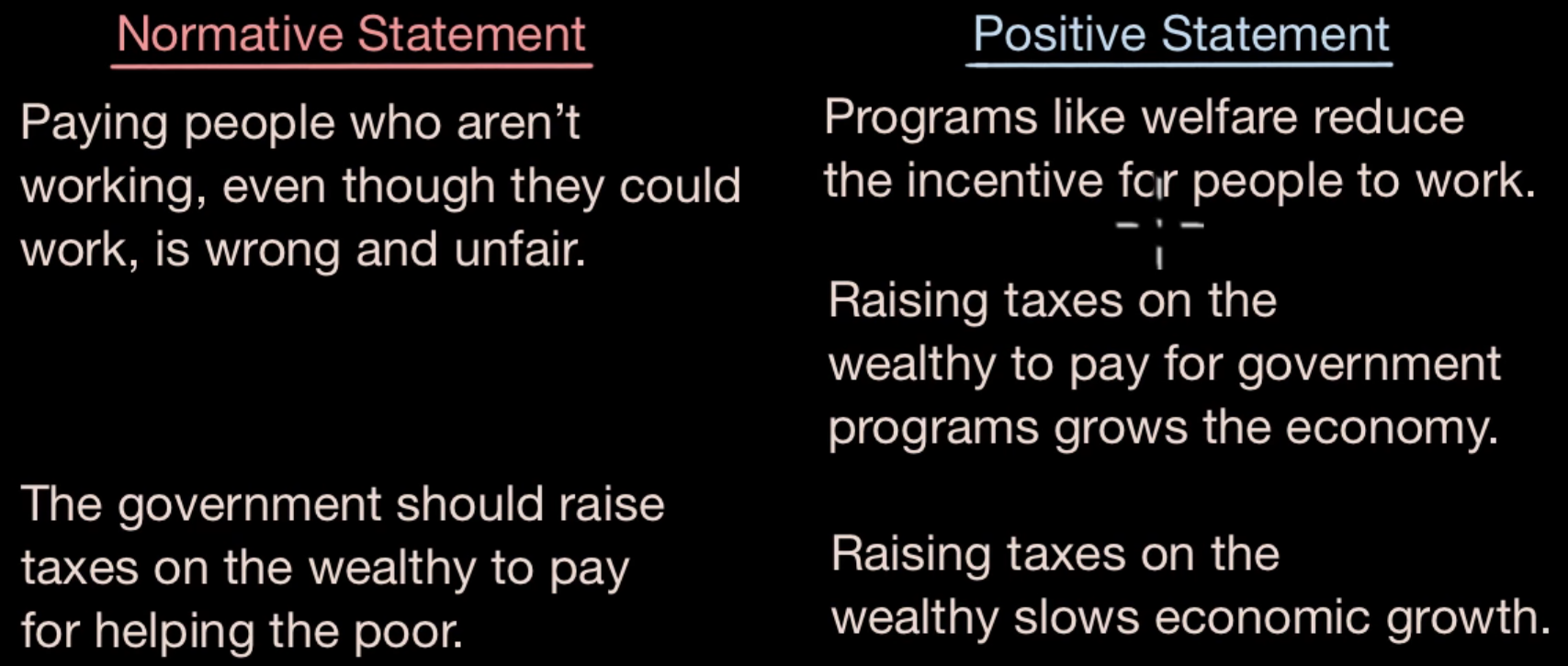

Normative statements refer to opinions that are a matter of ethics or morals, something that someone thinks is how the wold should be, while a positive statement is something that doesn't necessarily have to be true, but it's something that can be tested.

1. 4. Economic models

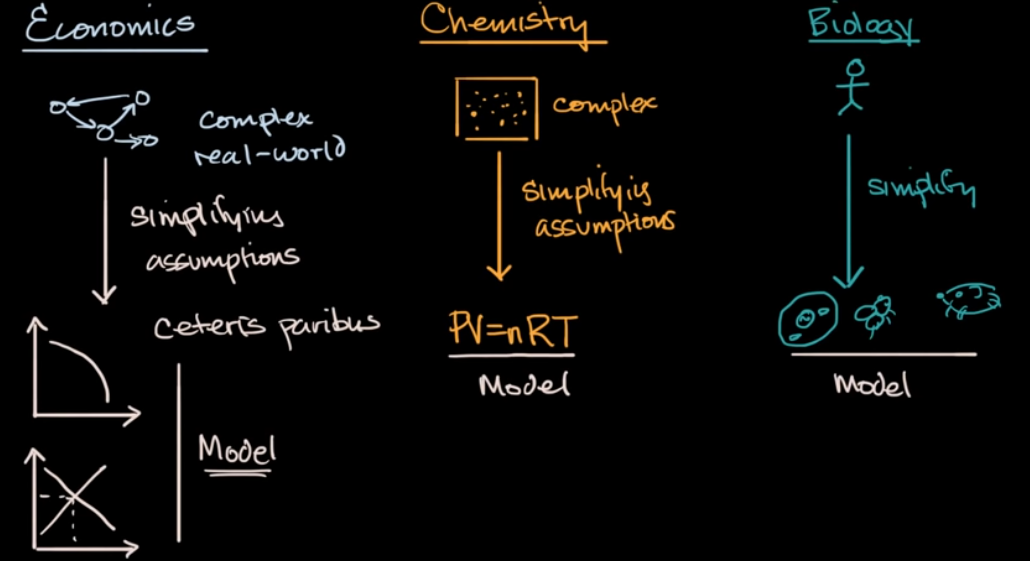

Like other fields, Economists are something that is complex, and making simplifying assumptions, 1> everyone is rational. 2> They have the same access to all information and have pefect information.

When you think about what the field of economics is about, it is quite daunting. An economy is made up of millions or even billions of actors organized in incredibly complex ways. This is complex real-world and each of the actors, human beings or organizations, these are incredibly complex.

A human brain. I can't predict what you're going to do the next second much less what you're going to do the next day or the next year and imagine trying to make insights about what millions or billions of people will do but the field of economics has borrowed an idea from other fields. So for example, in chemistry, chemists have tried to understand at a high level, well, how do molecules in a container behave? Let's say molecules of gas. Well, you could imagine if you have a container here with trillions of molecules, this is incredibly complex, but by making some simplifying assumptions about the type of interactions which these particles will have or don't have, they can come up with models (it's an equation: PV=nRT) like the ideal gas law that relates the pressure to the volume to the number of particles, which you have, to the actual temperature and so you're taking something that's complex, and making simplifying assumptions to help you understand it, this thing right over here is a model and this is in other fields as well.

Sometimes, even a mouse is a very complex thing but it's still simpler than a human being and at least to our modern ethics, we're willing to do certain things to mice that we aren't willing to do to human beings and so that's why in a biological context, you will hear people talk about things like a mouse model where they will test a drug on a mouse or try to understand how something happens in a mouse and then say, well, that's a pretty good indication that might be happening to human beings. In fact, when they do drug trials in medicine, they often will do it on mice first and when they have good confidence that it works there and that it's fairly safe, only then will they start to do the experiments on human beings.

Well, economists are doing the same thing. Even before the advent of computers and computer models, economists make simplifying assumptions, assumptions like all of the actors in an economy are rational which we already know is not exactly true. They're simplifying assumptions that all of the people in an economy have the same access to information or that they all even have perfect information which we also know isn't necessarily true in a real economy. So depending on the model, there are going to be these simplifying assumptions that take this large, complex real-world thing and try to break it down into simple equations or lines or charts.

We have models early on in our economic study. We will see things like the production possibility frontier where it assumes that you're only trading off between two things and everything else is equal, this notion of ceteris, ceteris paribus which means all things equal. In a real-world, you're not gonna be able to say, hey, let's just pick between these two things and then hold everything else equal. There's hundreds or thousands or millions of variables are operating but if you wanna make a model, maybe we can make these assumptions.

Same thing with famous price equilibria that we're going to study later on where you have supply and demand and then you have these notions of equilibrium prices and quantities. These also make similar types of assumptions about rational actors and perfect information and these economic models can be very useful and that's why most of your study in a first year economics course is of these models. Now, with that said, you should also take them with a grain of salt and you shouldn't just accept them as the absolute description of reality.

1.5. command and market economies

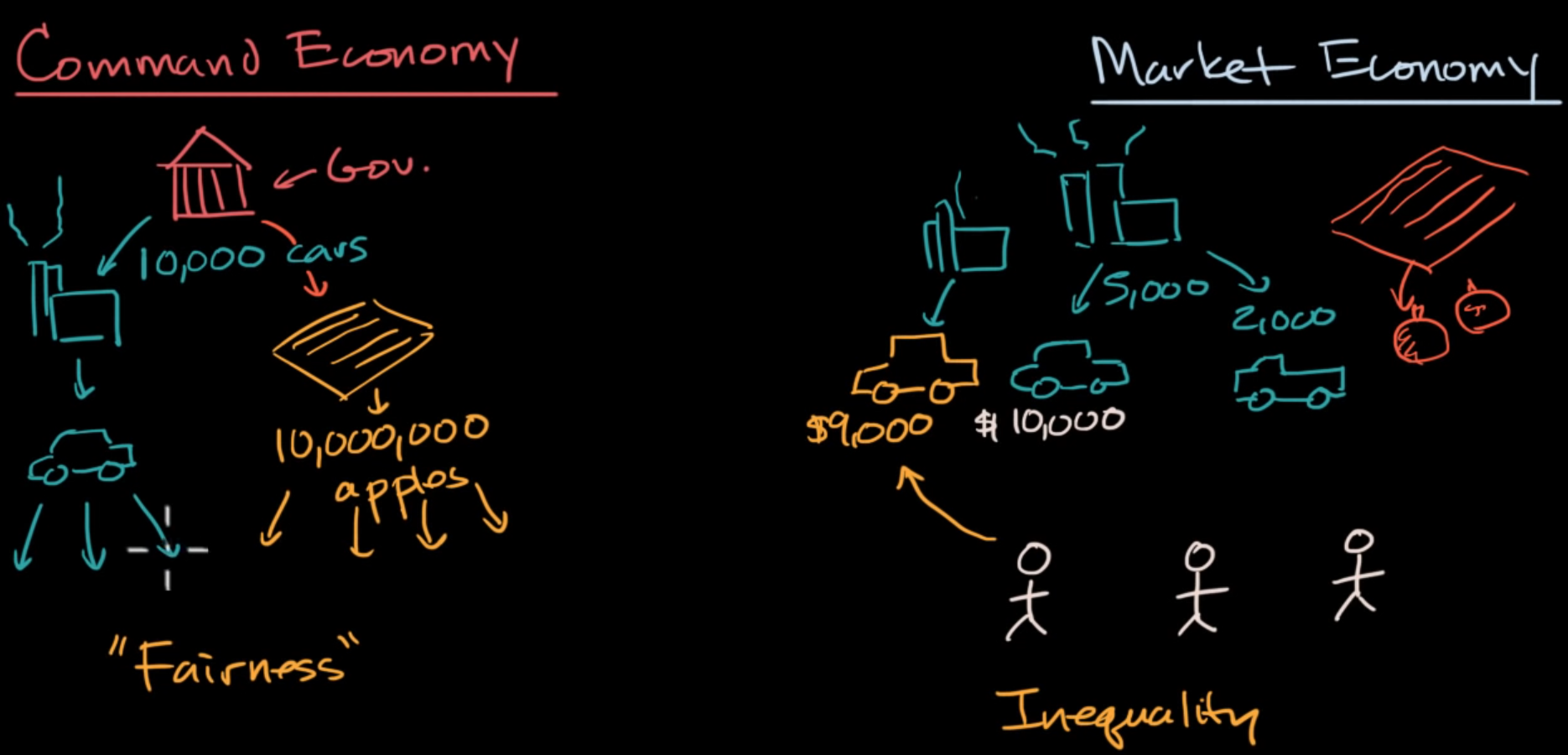

the difference between command economy and market economy is the different ways of structing an economy: in particular, who owns what and how does an economy decide what to produce and who gets the output of that production.

in a command economy, the government controls the facotors of production, and sometimes, there might not even be private ownership. in an extreme command economy, Products, like cars and apples, will be directly produced and allocated by the government without basing on who's willing to pay for the car or who could pay the most for the car. Similarly for the apples. so there will have to be a lot of planning done by the government. "how much should we produce of one thing versus another thing and how do we decide who gets the different things?"

Rather than having the government owning the factors of production, deciding who produces what and how much and who gets those things. in a markert economy, it's all based on marketplace needs. Products get produced and who will gets these will not dictated by the govement, while it's determined by the market. The market will dictate who gets what. So for example, the factory might set a prize for the car. They might say 10000$ for a car, I might think it's a little bit higher than I expect, so I buy the other car for $9000. The prices themselves won't necessarily be fixed. If they're not selling enough of these cars at $10000, they might lower the price to compete with the yellow car at $9000. Similarly, if there is a ton of people who are willing to pay the price of this truck, they might raise the price on the truck or produce more of it. So there is a strong motivation to be able to meet the needs of the marcket and then the prices adjust accordingly.

Some of the original ideas behind command economies, like communism where we don't like this inequality, we wanna see more fairness. So we wanna see everyone get exactly the same things. Now it turns out in reality, that's a little bit utopian. People who might have carried favor with the leadership, had more power, who had better apartments, better cars. had more access to resources and people who didn't.

In a marcket economy, there will be some inequality, but the best thing going for it, and the reason why the most nomally economy, like the chinese economy, have transitioned to a market economy, because a market economy is also associated with things like Innovation and strong incentives for people.

ctrolled by the government, more and less.

Sum up what economics means:

Economics is the study of how individuals and societies choose to allocate scarce resources, why they choose to allocate them that way, and the consequences of those decisions.

Scarcity is sometimes considered the basic problem of economics. Resources are scarce because we live in a world in which humans’ wants are infinite but the land, labor, and capital required to satisfy those wants are limited. This conflict between society’s unlimited wants and our limited resources means choices must be made when deciding how to allocate scarce resources.

microeconomics: the study of the interactions of buyers and sellers in the markets for particular goods and services

macroeconomics: the study of aggregates and the overall commercial output and health of nations; includes the analysis of factors such as unemployment, inflation, economic growth and interest rates.

positive analysis: analytical thinking about objective facts and cause-and-effect relationships that are testable, such as how much of a good will be sold when a price changes.

normative analysis: unlike positive analysis, normative analysis is subjective thinking about what we should value or a course of action that should be taken, such as the importance of environmental factors and the approach to managing them.

2. 1 Opportunity cost and the Production Possibilities Curve