Part I

Variances and Invoice Blocks

Block的主要原因是因为发票价与订单价或数量产生了差异.需要人工再确认一下才可以付款.

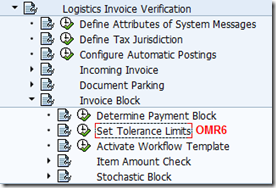

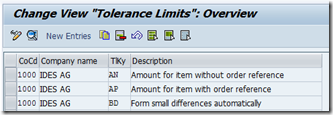

主要有这几种Tolerance Key:

Purchase order price quantity variances (tolerance key BR, BW)

Quantity variances (tolerance key DQ, DW)

Price variances (tolerance key KW, PP, PS)

Date variances (tolerance key ST)

The check on amounts (AN, AP)

For small differences (BD)

For variances to blanket purchase orders (LA, LD)

For maximum changes of the moving average price (VP).

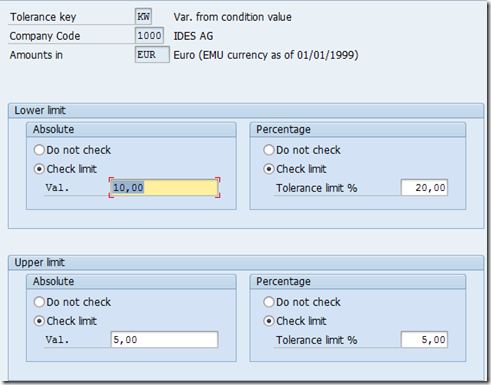

如果任何一个limit超过,都给出一个警告

如果upper limit超过了,警告+block invoice(当upper limit设为0时,则阻止所有发票)

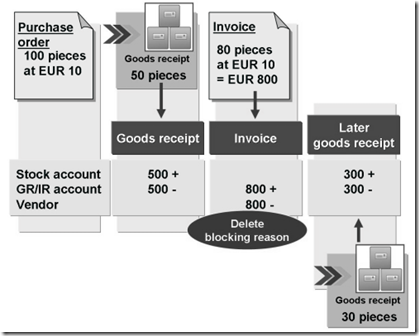

Postings for a Quantity Variance 数量差异怎么过帐呢?

差异部分(30PCS*10=300EUR)计入GR/IR科目:

-期待再一次的30PCS的收货

-或开一张credit memo将差额讨回

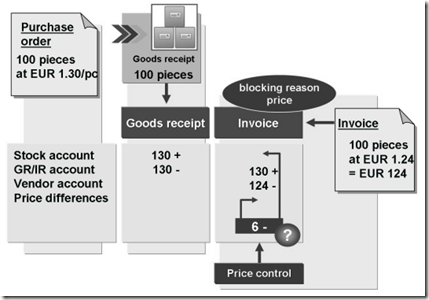

Postings for a Price Variance 价格差异怎么过帐呢?

发票过帐在收货之后:

- 标准价的话,过帐给price differences account

- 移动平均价,过帐给stock account

发票过帐在收货之前:

- 价差过帐到GR/IR科目,待收货后,再根据S或V,分配给stock account或price differences account

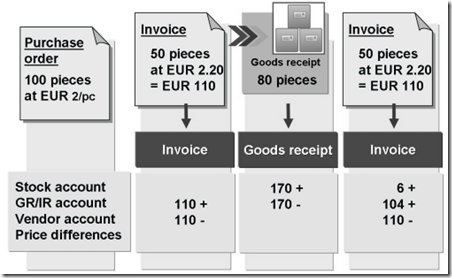

Postings for Quantity Variance and Price Variance 数量,价格都有差异怎么过帐?

如果发票过帐早于收货, 发票金额过帐到GR/IR科目(110EUR)

之后做收货:

如果收货数量与之前的发票数量一致, GR/IR就被冲销了110-

- 如果是移动平均价,则110+ 抵消到stock account.在计算物料价时,使用发票价而不是采购单价

如果收货数量大于之前的发票数量(80>50), 则用发票价来计算收货的金额(80*2.2=170)到GR/IR科目

之后又来了一票50PCS的发票..不明白104怎么算出来的..帐目不平了啊…

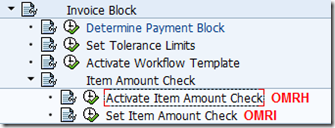

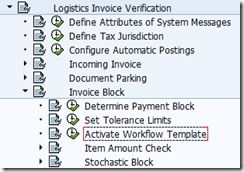

Block due to amount 仅仅因为金额高,也可以block

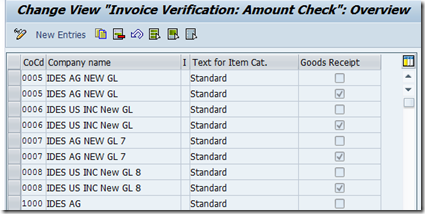

根据company code激活[OMRH]

根据item category和GR标识,决定是否要block[OMRI]

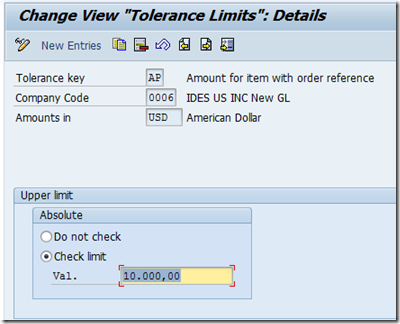

[OMR6]选择tolerance key AP/AN

由此,当金额超过10,000时,则给出阻止理由:amount

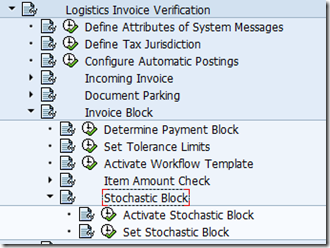

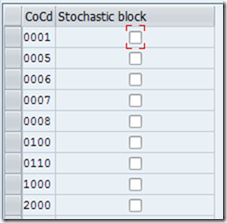

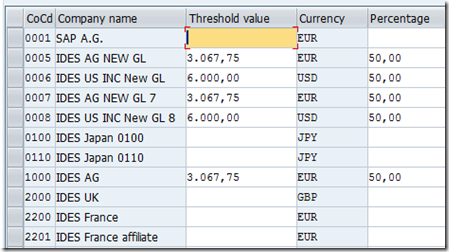

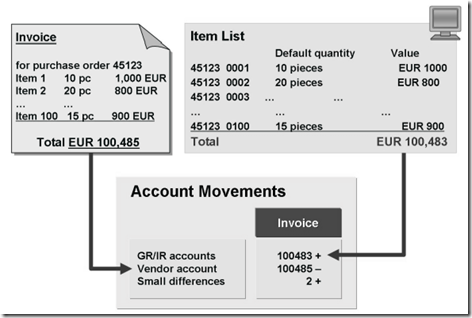

Stochastic block 随机阻止

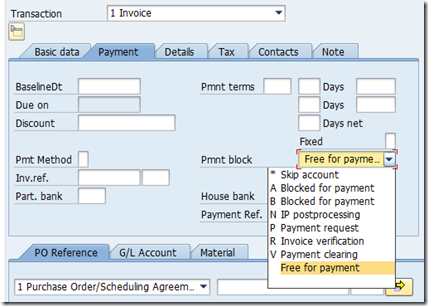

Manual Block 手动阻止

在[OMR9]配置

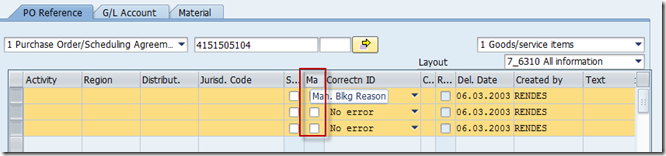

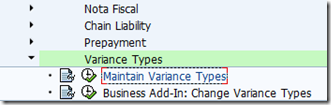

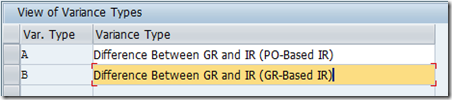

Variance Type (As of ECC6.0)

This field highlights possible errors in the invoice item and therefore acts as a starting point for the invoice verification clerk. Standard SAP systems contain

the following values:

BADI MRM_VARIANCE_TYPE决定准入条件

PART II

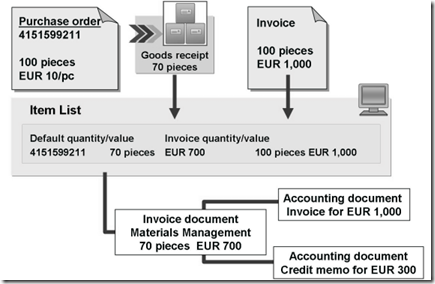

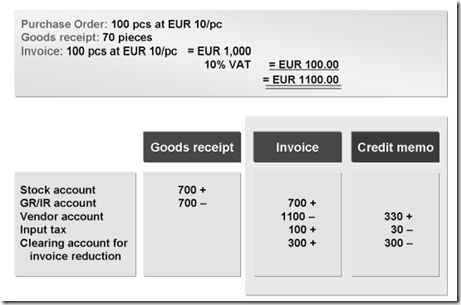

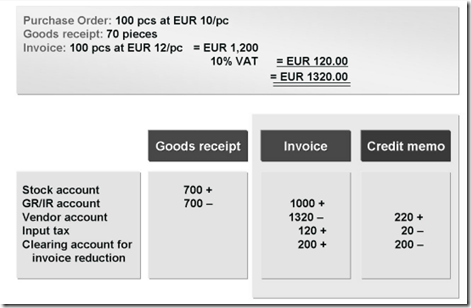

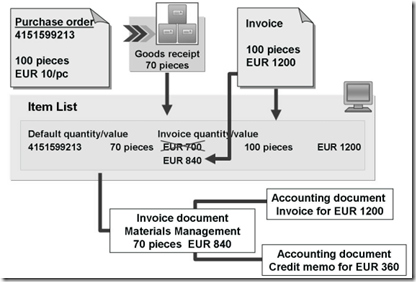

Invoice Reduction

与下一个例子的区别在于,发票过帐时,GR/IR科目计入了70*10=700EUR(按收货数)

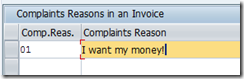

When you reduce invoices, the system creates an invoice and a credit memo simultaneously.

The item amount entered in the invoice you create is distributed in the following way:

The system only posts the amount (700) shown in the suggested data to the GR/IR clearing account. It posts the remainder to a clearing account for vendor invoice reduction.(300)

The creation of the credit memo clears the clearing account for vendor invoice reductions. The offsetting entry is made to the vendor account.

The system makes the tax posting in the invoice based on the item amount entered(30). The credit memo corrects the tax posting.(330)

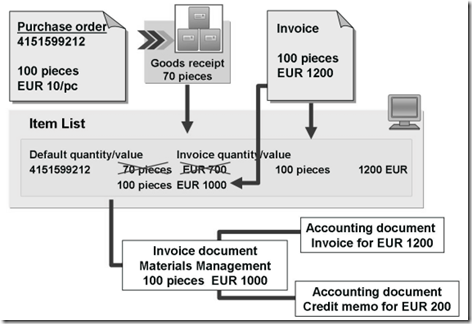

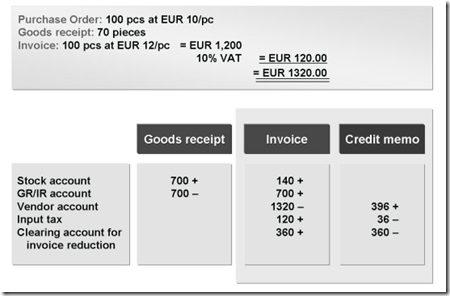

Partial Reduction Price Variance

You can partially accept variances. In this case, you only reduce the part of the invoice that you have not accepted.

The above invoice contains a quantity variance and a price variance. If you accept the quantity variance, you must overwrite the suggested quantity with the actual quantity in the invoice. Accordingly, you must also overwrite the suggested amount with the correct amount for the quantity entered. You then reduce the invoice by the difference between the actual invoice value and the default value entered.

与上一个例子的区别在发票过帐时,GR/IR科目计入了100*10=1000EUR(按订单数)

Since you have accepted the quantity variance, the system posts 1000 EUR to the GR/IR clearing account (the system expects another goods receipt for 30 pieces).

The EUR 200 difference between this and the invoice amount is posted to the clearing account for vendor invoice reductions.

The creation of the credit memo clears the clearing account for vendor invoice reductions. The offsetting entry is made to the vendor account.

Together, the invoice and the credit memo create the liability, resulting from the changes made to the data suggested by the system.

Partial Reduction Quantity Variance

In an invoice with quantity and price variance, the price variance may be accepted, but not the quantity variance. In this case, the default value must be overwritten with the result from the default quantity multiplied by the actual invoice price. You then reduce the invoice by the difference between the actual invoice value and the default value entered. You then reduce the invoice by the difference between the actual invoice value and the default value entered.

该例中将70*100=700计入了GR/IR科目(订单价)

Since you have accepted the price variance, the GR/IR clearing account in the invoice is cleared and the price difference is debited to the stock account (if material with moving average price and adequate stock is required). The EUR 360 difference between this and the invoice amount is posted to the clearing account for vendor invoice reductions.

The creation of the credit memo clears the clearing account for vendor invoice reductions. The offsetting entry is made to the vendor account.

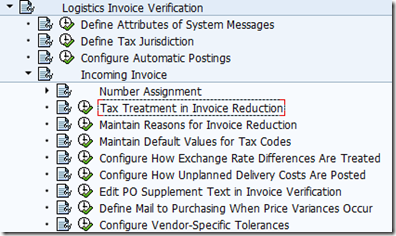

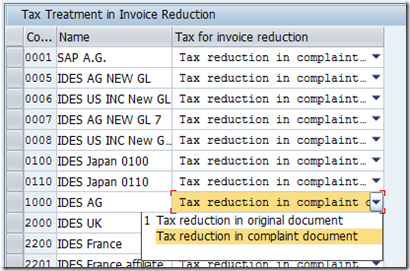

配置:

Maintain reasons for invoice redution (as of EHP03)

Variances Without Reference to an Item

业务需求: 行项目太多了,不可能一个个去查

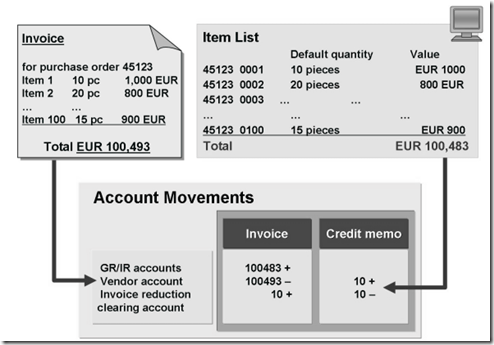

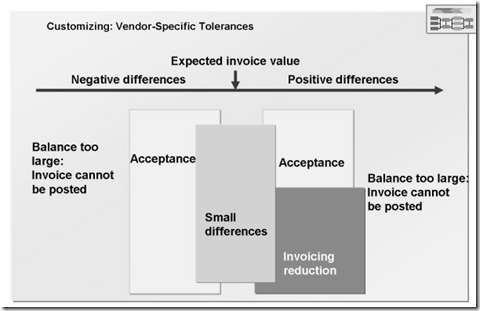

1. Total-based invoice reduction (有时供应商提供的发票比实际订单价要高一点,因为有太多行项目,为了不用一条条查找,直接对发票总价做抵扣)

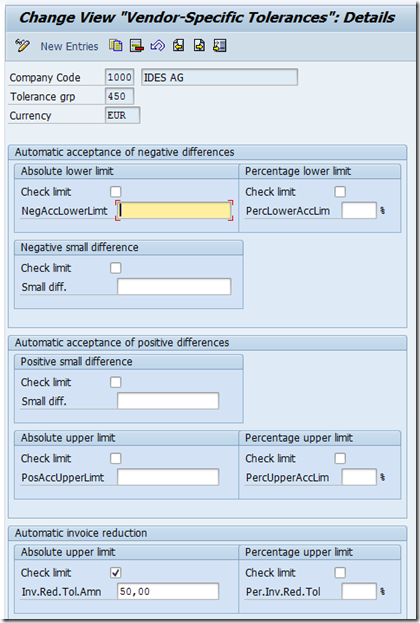

前提: Automatic reduction of an invoice depends on whether you have assigned a tolerance group to the vendor in the vendor master record, and on the relevant

Customizing settings for this tolerance group.

输出: The system creates two accounting documents when you post the invoice.

- The first document contains the invoice postings and an additional posting to a clearing account.

- The second document contains a credit memo, which creates the offsetting entry to the clearing account.

所以,实际上应付账款=发票价-credit memo价

When you post an invoice reduction, the system creates a message record. You can use this to send a letter of complaint (notification of credit memo posting) to the vendor.

2. Total-Based Acceptance (供应商发票高一点点,接受了)

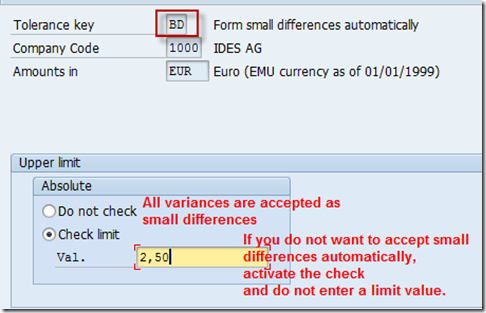

[OMR6] Tolenrance Key BD

[OMRX]

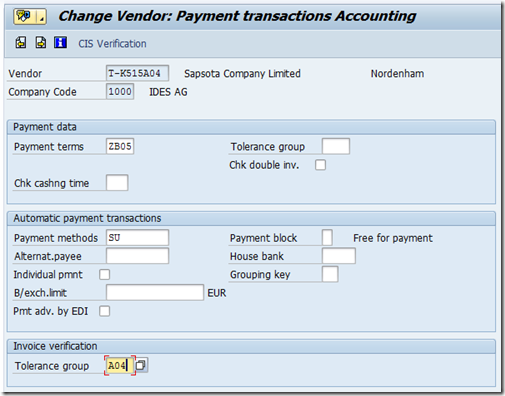

在供应商主数据中维护tolerance group, 该配置优先级大于[OMR6]

[XK02]—>In the Company code data area, select Payment transactions.

2.1. Vendor-Specific Tolerances

Negative Differences: You can specify a tolerance for small differences, and for total-based acceptance in the invoice.

- If the negative difference falls within the configured tolerance limits for negative small differences, the system creates a posting to the relevant small

differences account.

- If the negative difference is larger than the configured small difference, the system checks whether it falls within the tolerance area for total-based

invoice reduction. If the difference falls within this tolerance area, the system posts the difference to the small differences account. If the difference

is greater than the defined tolerance for total-based acceptance, the invoice cannot be posted.

Positive differences: You can specify a tolerance for small differences, a tolerance or total-based acceptance, and a tolerance for total-based invoice reduction.

- If the positive difference falls within the configured tolerance limits for positive small differences, the system creates a posting to the relevant small

differences account.

- If the positive difference exceeds the small difference tolerance, the system checks whether it falls within the defined invoice reduction limit. If it falls

within the tolerance for total-based invoice reduction, the system performs a total-based invoice reduction for the difference amount. If the invoice reduction limits are set to Do not check, the system compares the variance with the limits for total-based acceptance for positive small differences.

3. Manual Acceptance

When you enter an invoice, if the difference is larger than the defined tolerances, the system displays the balance and the traffic light is red.

To post the document anyway, choose Edit → Accept and Post. This means that you manually accept the difference, and it is posted to the defined small difference account.

The option of manually accepting small differences is linked to the authorization object M_RECH_AKZ.

Hint: The manual acceptance function is not available when you further process parked documents.

PART III

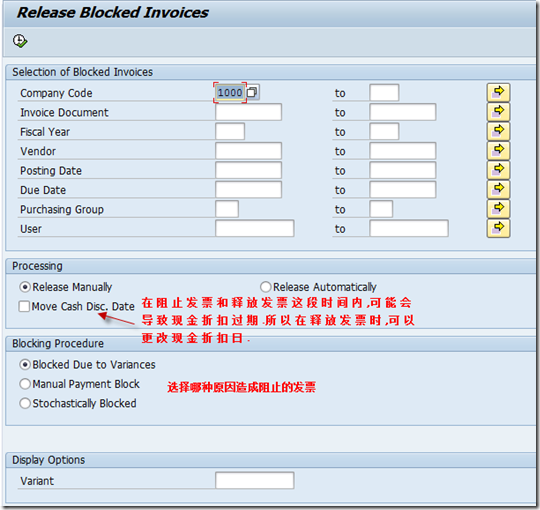

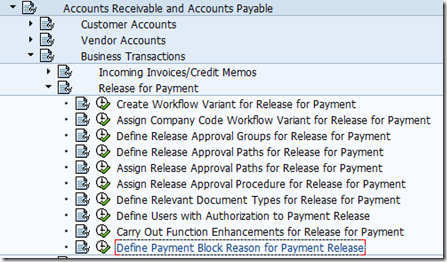

Releasing Blocked Invoices

原因:

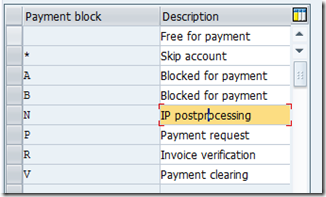

当有差异/手动设置了付款阻止/随机阻止/付款条款造成的阻止

释放方法:

1. 当剩余货物到达,或采购单价变更后,被阻止的发票自动会被释放

[MRBR]

2. 自动释放 (仅适用于差异造成的发票阻止,即价格,数量,时间差异,或者数量检查)

系统检查是否阻止原因还有效..如果都无效了,则发票自动释放.

Blocking reason Q (quantity) may no longer apply after the arrival of a further delivery or a credit memo. Blocking reason D (date) becomes invalid over time.

Note that with a goods-receipt-based invoice verification, the goods receipt must be entered as subsequent delivery for the material document of the first goods

receipt. Only then can the assignment be made between the invoice and goods receipt.

Blocking reason P (price) may no longer apply if you change the purchase order price or if you receive a subsequent credit. Blocking reason Q (quality) becomes

invalid when the goods pass the quality inspection.

[Program RM08RELEASE]

可以删除掉blocking reason

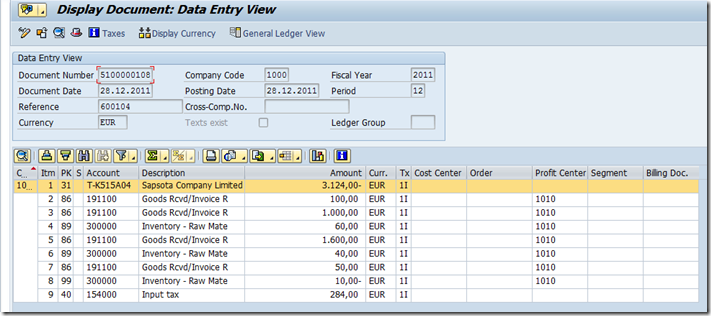

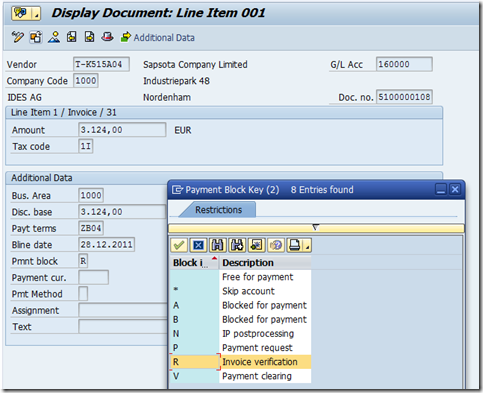

释放后,可以查看accounting document里的vendor item

You can define whether each payment block can be changed in the proposal of the payment run.

Worflow

workflow template WS20000397