https://www.liberatedstocktrader.com/top-20-best-stock-market-websites/

The 20 Best Stock Market Websites Tested & Reviewed. Which Sites are Best for News, Charts, Forums, Research, Advisory Services & Market Analysis

Table of Contents

There is a wealth of online stock trading & investing services available today. I feel I can recommend the best websites and services through my 20 years of investing and trading as a certified market technical analyst.

Here are the highest quality stock market sites providing accurate data, and superior tools for stock chart analysis, research, news, online trading, and community.

1. TradingView: Best Stock Website

TradingView is an excellent website for charting, screening, backtesting, and its user community. With over 2 million active daily users, who share ideas and post comments, TradingView is a great place to learn. TradingView is extremely popular because it does everything well.

TradingView has over 160 different indicators and unique charts such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko; you have everything you will need as an advanced trader. When it comes to drawing tools for trendlines, text, and chart analysis, TradingView has the best selection in the industry with over 100 different options.

The user community has also developed an enormous range of custom and shareable indicators.

TradingView – Insanely Beautiful Charts, with a massive selection of indicators. This Chart Features the Moon phase and Darvas Boxes.

TradingView – Insanely Beautiful Charts, with a massive selection of indicators. This Chart Features the Moon phase and Darvas Boxes.

There is no doubt about it; TradingView is simply the best overall Stock, Forex, and Cryptocurrency analysis website. TradingView has fully integrated social networking and global data from nearly every exchange in the world and at a great price, which starts at free.

I use TradingView every day and post stock chart analysis and commentary. Follow me on TradingView.

Connect & Follow Me On TradingView For My Latest Trading Ideas & Chart Analysis

Connect & Follow Me On TradingView For My Latest Trading Ideas & Chart Analysis

Trade Management, Scanning & Screening

With TradingView, you get broker integration so you can place trades on charts, and it will take care of profit & loss reporting and analysis for you. The only thing it does not cover is Stock Options Trading.

Another massive plus for TradingView is they hit the mark on fundamental and technical screening and filtering, with powerfully customizable watchlists. The list of fundamentals you can scan & filter on is genuinely huge. Thanks to a connection to the Federal Reserve database, they even have economic data like Federal Funds Rates and World Economic Growth.

You can have TradingView for free; it is also a review winner for our Best Free Charting Software Review. You can open a TradingView chart now with a single click; no registration is needed. However, to unleash the true potential, I would recommend going for the PRO+ service at $19.95 per month or the premium at $39.95 per month; the benefits are extensive, including priority customer Support and unlimited everything.

Watch this video on YouTube

| Visit TradingView | Read the TradingView Review |

2. Trade Ideas: Best AI Stock Trading Site

Founded in 2003, Trade Ideas is a web & desktop-based software platform for finding day trading opportunities. Historically specializing in real-time scanning, Trade Ideas now incorporates cutting-edge AI algorithms that backtest every stock in the USA & Canada for high probability trading opportunities.

Trade Ideas is designed to give day traders an edge. Being a day trader is extremely difficult because the institutional investors have the advantage due to the computing power and algorithms they run that control the market. The retail investor has literally no chance to be successful. Trade Ideas is designed to help correct the imbalance by providing retail investors with cutting-edge, institutional-grade AI to help make better trades.

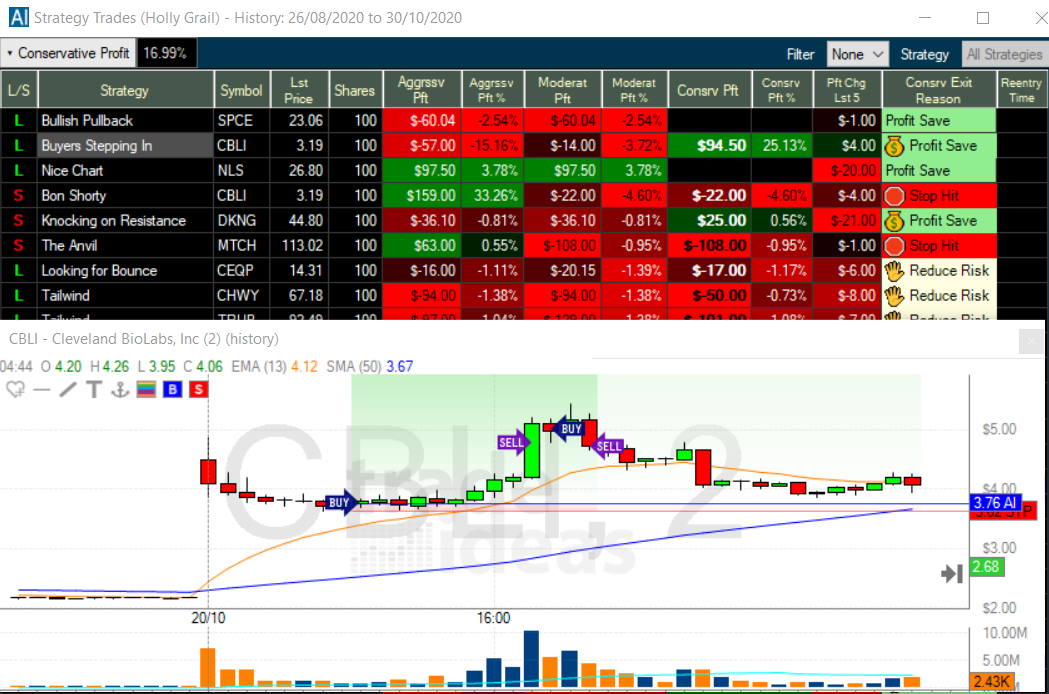

One thing I really like about Trade Ideas is that it visually shows you every signal buy and sell signal on a chart. In the chart below, I have highlighted a trade recommended by Holly AI (Holly Grail). This trade for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within a 4 hour period. Not how the buy and sell signals are depicted on the chart.

Trade Ideas – Trades & Buy & Sell Signals

Trade Ideas – Trades & Buy & Sell Signals

Trade Ideas Pro AI

The AI algorithms developed by Trade Ideas are the main reason you would want to sign up. I had a lengthy zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how the AI works, and I was very impressed. This company is laser-focused on providing traders with the very best data-supported trading opportunities. There are currently four AI systems in operation.

Holly is 3 AI Systems Applying Over 70 Strategies Differently.

Holly AI applies 70 different strategies to all the stocks on the US & Canadian stock exchanges, including pink sheets & the counter (OTC) markets. 70 strategies multiplied by 10,000+ stocks means millions of backtests every day. Only the strategies with the highest backtested win rate over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trade the following day. You can even register to receive a Holly AI trade of the week direct to your inbox.

Holly 2.0 is a more aggressive version of Holly AI, presenting more aggressive day trading scenarios for you to choose from. Trade Ideas operates 3 key trading styles with each AI engine, Conservative, Moderate & Aggressive. Holly 2.0 is aggressive.

Holly NEO is a newer AI, which seeks to trade real-time chart patterns. It utilizes a mix of the following strategies.

- Pullback Long – Seeks to identify trades where the stock price is down and is seeking to start moving up on higher volume.

- Breakout Long – Where stock price breaks out up through a key resistance or to new highs.

- Pullback Short – identifying a short pullback opportunity in price.

- Breakdown Short – a shorting opportunity where upward momentum breaks down.

Trade Ideas Standard costs $118 per month; for this investment, you get:

- Live Trading Room – Full access to the live trading room. Try the Trading Room for Free Now

- Real-time Streaming Trade Ideas – Scanner providing access to 40 pre-configured scans.

- Simultaneous Charts – The ability to have 10 chart windows open.

- Chart Based Visual Trade Assistant – The ability to trade directly from charts.

- Up to 500 Price Alerts – Price alerts to notify you when a stock meets your criteria.

- Channel Bar Curated Workspaces – Access to 30+ channels of ideas.

Trade Ideas Premium costs $228 per month. For this extra cash, you get access to everything above, but also the robust backtesting and the Holly Artificial Intelligence System, including:

- A.I. Virtual Trading Analyst Holly – 4 different constantly evolving A.I. algorithms

- Chart Based A.I. Trade Assistance & Entry and Exit Signals

- Risk Assessment – Detailed information on the backtested performance of the recommended trade.

- Build and Backtest any Trade Idea – Compelling point & click backtesting system.

- Autotrade w/ Brokerage Plus and A.I. – Advanced auto trading using Interactive Brokers.

As a partner of Trade Ideas, I requested a discount for all our readers. Use the discount code “Liberated” to get 15% off your first purchase, worth $340 when going for the premium service.

| Get 15% Off Trade Ideas | Read the Full Trade Ideas Review |

3. MetaStock: Best Backtesting & Forecasting Site

If you are looking for a website that provides the best stock backtesting and forecasting software, MetaStock.com is the leader. MetaStock provides the best technical analysis tools on the market with over 360 different indicators, drawing tools, and chart types.

MetaStock also excels at real-time news with its Refinitiv Xenith integration. Our testing also shows that the backtesting capability of MetaStock is first-class. MetaStock is a giant in stock market analysis software; you can expect excellent fast global exchange data coverage, including Equities, Futures, Forex, ETFs, and Options.

MetaStock has full Refinitiv XENITH integration with institutional level news, analysis, and outlook; This is the fastest global news service available on the market, including translations into all major languages.

The most significant MetaStock innovation is the forecasting functionality, which does not exist with any other software. By selecting Forecaster from the power console, you can simply choose one or more stocks, ETF’s or Forex pairs and click forecast. You are then presented with an interactive report which enables you to scan through the many predictive recognizers, which help you understand the basis for the prediction and the methodology.

The Wonderful MetaStock Forecasting Tool

The Wonderful MetaStock Forecasting Tool

Scanning & Trade Management

Using Refinitiv XENITH, you can see an in-depth analysis of company fundamentals from debt structure to top 10 investors, including level II data. Add to this excellent watchlists featuring fundamentals and robust scanning of the markets.

Prices start at $69 per month for MetaStock D/C, which is good for all the systems testing and forecasting requiring end-of-day data only. If you want intraday real-time data, you will need to opt for MetaStock R/T, costing $99 per month. For the ultimate solution, I would recommend MetaStock R/T Subscription with Refinitiv XENITH; this costs $199 per month and gives you real-time institutional-grade news.

| Read the MetaStock Review | MetaStock 3 for 1 Deal |

4. Stock Rover: Best Stock Research Website

Our testing reveals that Stock Rover is the best website for stock research, fundamental screening, and portfolio management. This is because Stock Rover maintains a complete 10-year historical financial database on all Stocks and ETFs in North America. Stock Rover is the best site for Value, Dividend, and Growth investors because its database enables granular stock screening strategies to be implemented.

You can even download free stock research reports here.

The list of fundamentals you can scan & filter on is genuinely huge; any idea you have based on financials is covered with over 600 data points and scoring systems.

Stock Rover Warren Buffet Screener – This screener is based on criteria described in the bestselling Buffettology book. The company should have a 10-year track record of generally increasing EPS with no negative earnings years; long-term debt, not more than five times annual earnings; average ROE over the past ten years at least 15%, average ROIC over the last ten years at least 12%, and earnings yield should be higher than the long term Treasury yield.

Stock Rover Warren Buffet Screener – This screener is based on criteria described in the bestselling Buffettology book. The company should have a 10-year track record of generally increasing EPS with no negative earnings years; long-term debt, not more than five times annual earnings; average ROE over the past ten years at least 15%, average ROIC over the last ten years at least 12%, and earnings yield should be higher than the long term Treasury yield.

Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can even set the watchlist and filters to refresh every single minute if you wish.

The Stock Ratings Engine

The team over at Stock Rover has implemented some great functionality; I particularly like the roll-up view for all the scores and ratings. Here I have imported the Warren Buffett portfolio, which includes his top 25 holdings. I have also selected the “Stock Rover Ratings” tab. This “Stock Rover Ratings” tab rolls up all analysis into a simple-to-view ranking system, saving a huge amount of time and effort while providing a wealth of insight.

Stock Rover already has over 150 pre-built screeners that you can import and use. You need to have the Premium Plus service to take advantage of this, I have reviewed many of them, and they are very thoughtfully built. One of my favorites is the Buffettology screener.

Stock Rover Research Reports

An excellent new addition to the Stock Rover platform is the Research report, which enables you to generate a professional human-readable PDF report on any particular stock’s current and historical performance.

I actively use Stock Rover every day to find the stocks that form the foundations of my long-term investments. I have also used Stock Rover to create many original high-performing investing strategies. Here is a list of original strategies and tutorials on Stock Rover.

Related Articles: Finding Great Stocks With Stock Rover

- 12 Legendary Strategies to Beat the Market That [Really] Work

- Our Beat the Market Screener [Actually] Beats the Market

- 4 Easy Steps to Build The Best Buffett Stock Screener

- 6 Steps to Build an Ethical ESG Investment Portfolio

- All Value Investing Strategies & Articles

- Use a CANSLIM Stock Screener Strategy To Beat the Market

Stock Rover Pricing

You can have Stock Rover for free; however, the real power of Stock Rover unleashes with the Premium Plus service. Moreover, their top tier of service is not even expensive when compared to the competition.

How Much Does Stock Rover Cost?

- Free $0 – Scanning for 10,000 stocks, 43,000 mutual funds & ETF’s, broker integration, portfolio analysis & market news

- Essentials $7.99 US /mo – 5 years of historical data, 10 fair value, and margin of safety ratings per month + earnings calendar

- Premium $17.99 US /mo – 350 fundamental metrics, 10 years of historical data, stock & ETF ranked screening. 10 stock ratings per month, 20 fair value & margin of safety ratings per month.

- Premium Plus (Recommended) – $27.99 US/mo – 10 years of historical screening, an unlimited margin of safety and fair value scoring, limitless stock warnings, and stock ratings + analyst ratings scoring.

I strongly recommend going for the Stock Rover Premium Plus at $27.99 per month. Why? Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring.

The lower-priced service tier limits the number of ratings, so go for the Premium Plus; it is well worth it at only $27.99.

Stock Rover is the best website for value, growth, and income investors. A 10-year financials & fundamentals historical library plus incredible scanners including all of Warren Buffett & Ben Graham’s favorite criteria like Fair Value, Margin of Safety, DCF, and so much more.

If you are a long-term investor, this is the software for you.

| Get Stock Rover Free | Read The Detailed Stock Rover Review |

5. Benzinga Pro: Best Stock News Website

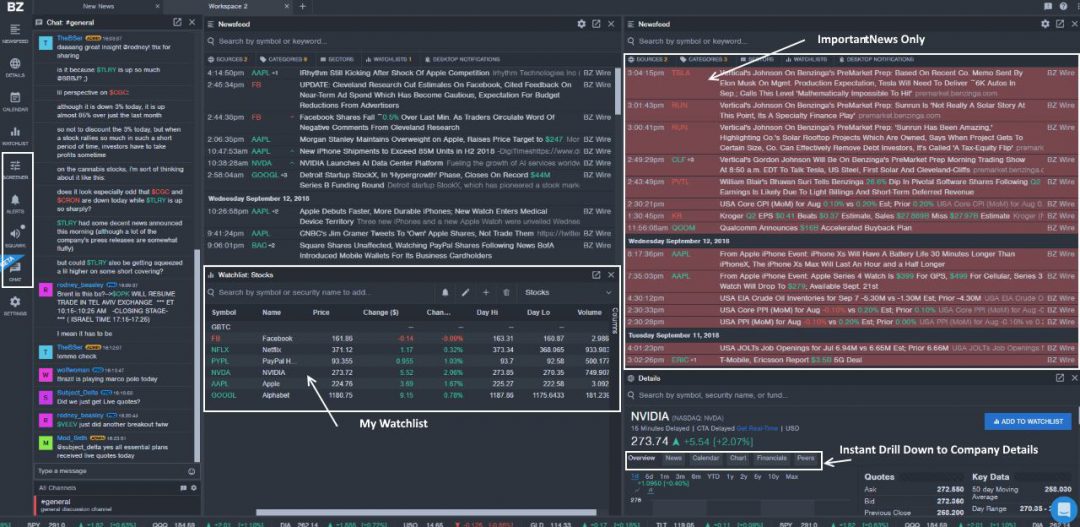

Benzinga Pro is the best real-time stock news website because it provides fast delivery of news, insider interviews, and direct access to the reporters at the news desk. If you are using the news to trade the stock market, Benzinga Pro has been designed for you.

The news platform is extremely configurable and able to run in multiple windows on multiple monitors. Benzinga Pro is extremely powerful yet easy to use, which is often a difficult balance to strike, and to top it all off, they have also now added real-time price quotes to the service, so you can see when news breaks the immediate impact on the stock price.

Screen Shot – Benzinga Pro News Platform Highlights – Important News, Watchlist – Price Quotes

Screen Shot – Benzinga Pro News Platform Highlights – Important News, Watchlist – Price Quotes

Benzinga is one of the major news providers you have probably never heard of. They do offer a huge amount of free news and thought-provoking original articles aimed at traders and investors for free on their website.

But suppose you are a frequent trader, especially if you are trading with the news, for example, short-term options trades at quarterly earnings announcement time, or you have a large stake in a company and need to be the first to know if the stock might tank due to a failed FDA application. You will want to upgrade to a version of the Benzinga PRO Service to get an edge in the market.

Benzinga Pro Video

Watch this video on YouTube

Benzinga PRO – Basic: ($79,- Per month)

This package offers the following:

- Newsfeed Access to the Core Benzinga newsfeed – Real-time (excluding SEC or PR Newsfeeds)

- WatchList Trade Alerts – setup your watchlist of stocks you hold or are interested in and receive real-time emails, app alerts, and audio alerts

- Security SnapShots – Unique to Benzinga is Security Snapshot View, essentially a summary of all the important News, Fundamentals, and Charts. Designed to give you a clean, quick view of the whole picture for a given stock. This includes all the core financial documents like balance sheets and important income statement information.

- Benzinga Calendar – A Great Way To Visualize what is coming up soon. Below we see the Benzinga Calendar, instantly you can see what Macro Economic News is upcoming, but what you also see in the column on the right is the potential impact of the news. As you can see, Benzinga has accurately rated the Existing Home Sales announcement as a potentially large impact.

Benzinga PRO – Essential ($147,- Per month)

In addition to the features above, the higher-level package includes the following benefits:

- Full Real-Time Newsfeed Access including all SEC news and PR Newsfeeds

- Real-time Audio Squawk – this is really impressive, I have it open whilst watching the markets, so I do not need to be watching the screen. Every 2 minutes, a real-time audio feed announces the latest news via my speakers – this service alone is worth the upgrade to Benzinga PRO Essential. As I was writing this article, an announcement came through that Novartis got FDA approval for a new drug. I just checked online; this is not on the web yet, nor announced on Bloomberg TV.

- Sentiment Indicators – this is an excellent feature that allows you to see the analyst’s sentiment visually; this is rated as 1 to 3 bulls or bears depending on how the analyst feels the news will move the stock. This is unique and a great asset.

- Chat with News-desk Feature – Imagine chatting directly with the analyst or reporter that submitted an article. This feature allows you to do just that by questioning the Benzinga news desk directly to deep dive into your own specific questions – straight from the hub of the news. The news team also highlights what they believe to be important news only for essential users.

- Exclusive CEO comments – Benzinga Analysts have frequent exclusive interviews with CEOs, and they publish exclusively key comments that may provide key insights into a stock you own.

- In-person Event Coverage at live earnings announcement events – if you trade earnings, this is your ticket to sitting at the event and getting analyst feedback as it happens.

If you are serious about trading in the stock market and need real-time access to the news that moves markets, then Benzinga Pro is a realistically priced and high-speed news service that is “designed by traders for traders.”

| Read the Full Benzinga Review | Benzinga Pro Free Trial |

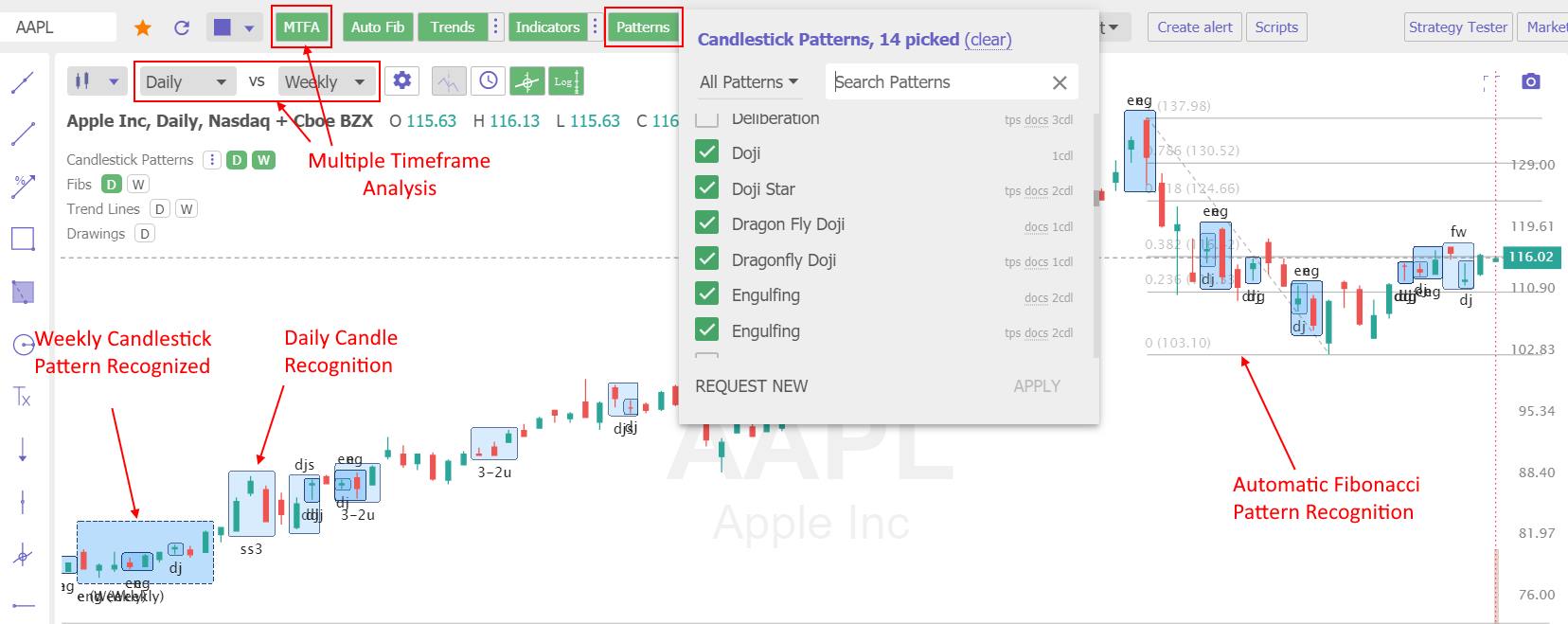

6. TrendSpider: Best Automated Stock Chart Site

Trendspider is the best website for stock traders wanting cutting-edge AI, automated trendline & candlestick pattern recognition, and system backtesting, all at a great price. Trendspider solves the problem of too much time spent doing analysis, drawing trendlines, tweaking indicators, and analyzing timeframes.

Automatic Trend Lines, Automatic Support & Resistance Lines, and Multi Time-Frame Analysis are new to finance and will change the industry moving forward.

Automated Trendline & Candlestick Detection

The automated trendline detection saves a lot of time for traders, speeds up trade preparation in the morning, and improves accuracy. The TrendSpider algorithm uses mathematics to correlate all the bars on a chart and then draw the lines. It highlights the touches at peaks and troughs in a price trend. As a technical analyst, this is how you are supposed to do it; the more times a price touches the trend line and reverses, the stronger the trend. Therefore, if a price breaks through strong support and resistance area, it is more predictive.

The Most Intelligent Candlestick Pattern Recognition On Multiple Timeframes With TrendSpider

The Most Intelligent Candlestick Pattern Recognition On Multiple Timeframes With TrendSpider

Multi-Timeframe Analysis

Here is where it gets even more interesting, the Multi-Timeframe Analysis can be used to super-impose trendlines or indicators from different timeframes onto a single chart. Instead of constantly switching timeframes and redrawing trendlines, it is simplý there. It is not just for trendlines; you can use it with the array of 42 stock chart indicators to ensure you do not miss anything. Dan Ushman, the company founder, uses it in his trading, especially with indicators like Bollinger Bands and with trendlines that help expose things other traders miss when they are focused on one timeframe or one indicator at a time.

I also really like the price indicator analysis; you can let the application plot, name, and highlight your Japanese Candlestick patterns of choice. Want to find Evening Doji Stars, Hammers, or Engulfing Patterns? Just turn on the pattern recognition; it is that easy.

Software & Pricing

Pricing starts at Free to try, but the real power comes in with PRO Trader Plan, which starts at $24.75 per month. This includes Real-Time Data, NASDAQ, NYSE & Amex Stocks, ETF’s, and, surprisingly, Cryptocurrencies. You also get unlimited lookups, trend detection, and 10 Dynamic Price Alerts + a free 30-minute personal one-on-one training session in this package.

The Elite Trade Plan is $37.25 per month, has everything the PRO plan has, and includes after-hours and pre-market data, OTC, Forex, and Futures data. On top of that, you get 20 Dynamic Alerts. Considering you get real-time data, the pricing is very competitive, in fact, considerably lower than other charting software vendors.

TrendSpider Market Scanner

TrendSpider is developing new features at breakneck speed, but this one is big. The latest innovation from the TrendSpider team is the “Market Scanner.” This enables you not only to scan a specific stock but the entire market for stocks matching your technical criteria. This is a major step forward, combining AI trend detection and analysis to scan the entire stock market.

| Visit TrendSpider Now | Read the Full TrendSpider Review |

7. Motley Fool: Best Stock Picking Website

One of the first books I read on investing was the Motley Fool Investment Guide back in 1997. The investment team of Tom and David Gardner and I have not looked back since. While I prefer to perform my own research and not be influenced by others, I have found the Motley Fool Stock Advisor Service incredibly useful.

Motley Fool does not try to perform research on every stock and fund in the USA. The team focuses on specific stocks that they feel will, over the long-term, significantly beat the S&P 500. They then provide lightweight and easy-to-read research reports and recommend why they feel the stock will be a long-term superior investment.

Motley Stool Stock Advisor Research

Motley Stool Stock Advisor Research

Uniquely, Motley Fool provides an audited track record of performance against the underlying benchmark. This is what is unique about the service; they actually try to beat the market and help you succeed in the long term. You could give them a try and follow their advice.

Motley Fool Stock Advisor Test Results Summary

Motley Fool Stock Advisor Test Results Summary

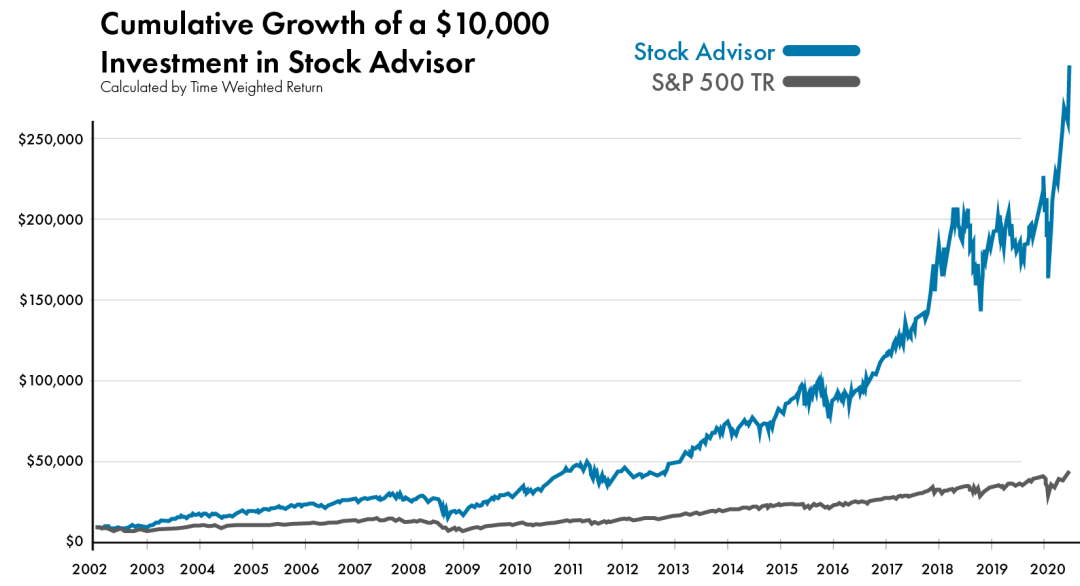

Motley Fool Stock Advisor Portfolio Performance 2002 to 2020

- Motley Fool Stock Advisor 421%

- S&P 500 85%

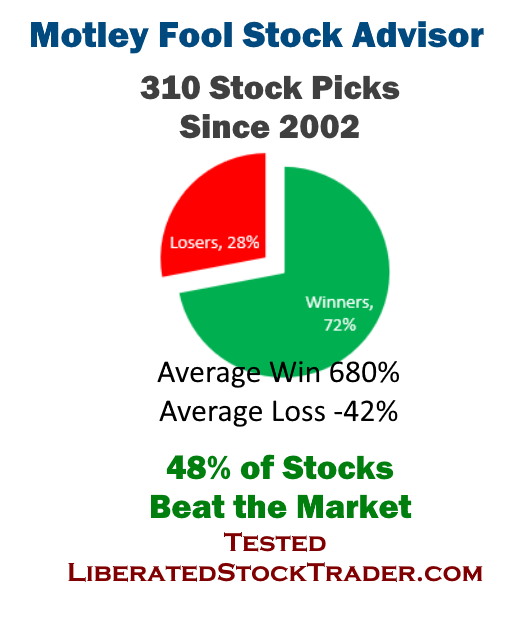

My independent analysis of the stock advisor service’s audited results reveals that since 2002, 48% of the stocks beat the S&P 500. The average winning stock outperformed the S&P 500 by 780%. 28% of the stocks recommended made a loss of 42% on average, while 82% of the stocks made a profit averaging 640%.

What does this mean? It means that you still have a 28% chance of losing money on any single stock recommendation. But at current performance levels, you have a 72% chance of investing in a company that will make you a profit.

The Stock Advisor service is well priced at only $99 for your first year and provides an audited track record of successful stock selection. The research reports are easy to read, and act upon, and targeted to long-term investors. They provide specific buy and sell signals on stocks they recommend, but the service does not include fund ratings.

Additionally, you can manage your favorite stocks through their simple to use portfolio tracker. I signed up for the service two years ago because I wanted to see what the competition was up to, but I found the service very simple and the research extremely compelling, insightful, and useful.

You could give them a try and follow their advice.

| Stock Advisor $199 or $99 for New Clients | Read the Motley Fool Test & Review |

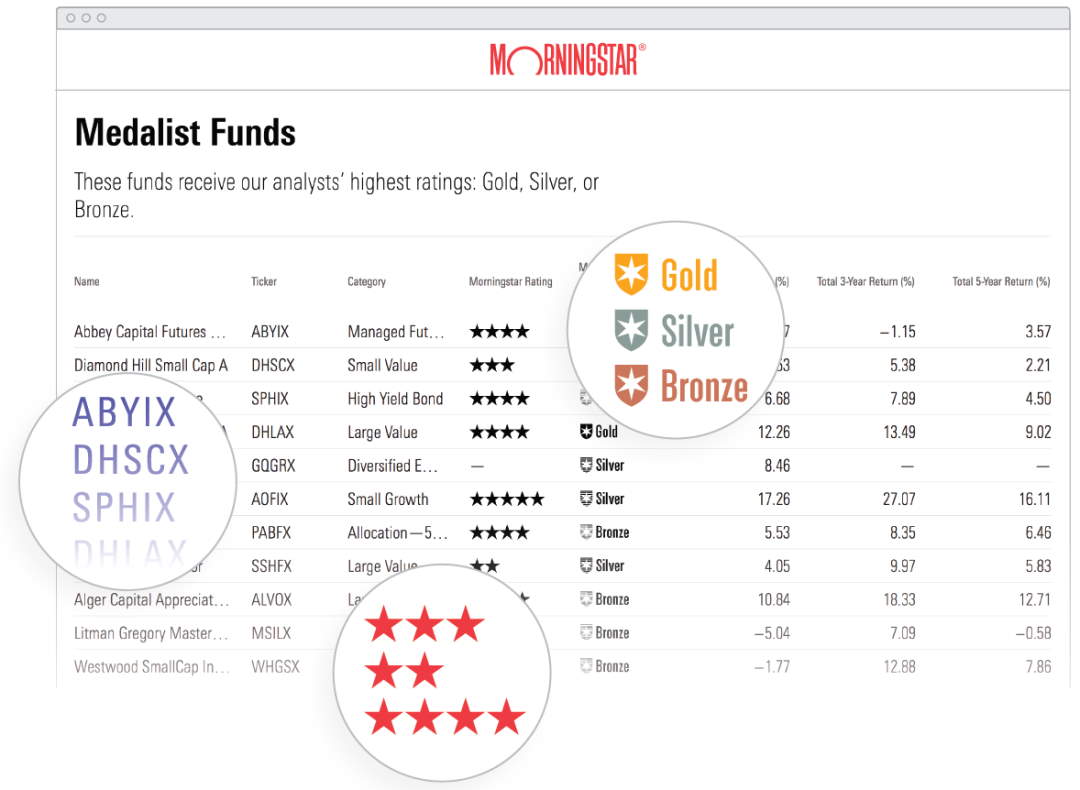

8. Morningstar: Best Stock & ETF Analysis Website

MorningStar has over 150 analysts providing research reports for all major stocks and funds in the USA. The research reports provided by Morningstar are curated; this means they are human-written reports by analysts. The analysts use a specific methodology to rate each stock based on the industry’s competitiveness, the company’s financial health, earnings growth, and fair value. They have also popularized the idea of an “Economic Moat,” meaning that if a company has a wide moat, it has a sustainable competitive advantage over its rivals.

Morningstar Ratings & Stock Research

Morningstar Ratings & Stock Research

Morningstar is clearly a leader for ETF and Mutual Fund ratings, so if you invest heavily in ETFs for diversification, this service could be ideal. Additionally, Morningstar provides portfolio management tools to enable you to evaluate and balance your portfolio.

Unlike Stock Rover’s research reports, which are generated in real-time and change quickly based on daily financial events, Morningstar reports update only every quarter. MorningStar research reports are great for a qualitative view of a company, whereas Stock Rover excels at quantitative analysis of the financials.

Morningstar is easy to use and packed full of great features and ratings. Add to this that it costs only $199 per year, and you have a well-balanced service.

Morningstar Premium is a competitively priced service targeted to long-term investors, providing detailed curated analyst reports and stock rankings to help improve your overall stock picking. The service does provide overall buy and sell signals but does not divulge the performance of their stock recommendations.

Get a 14 Day Free Trial + a $100 Discount at MorningStar.

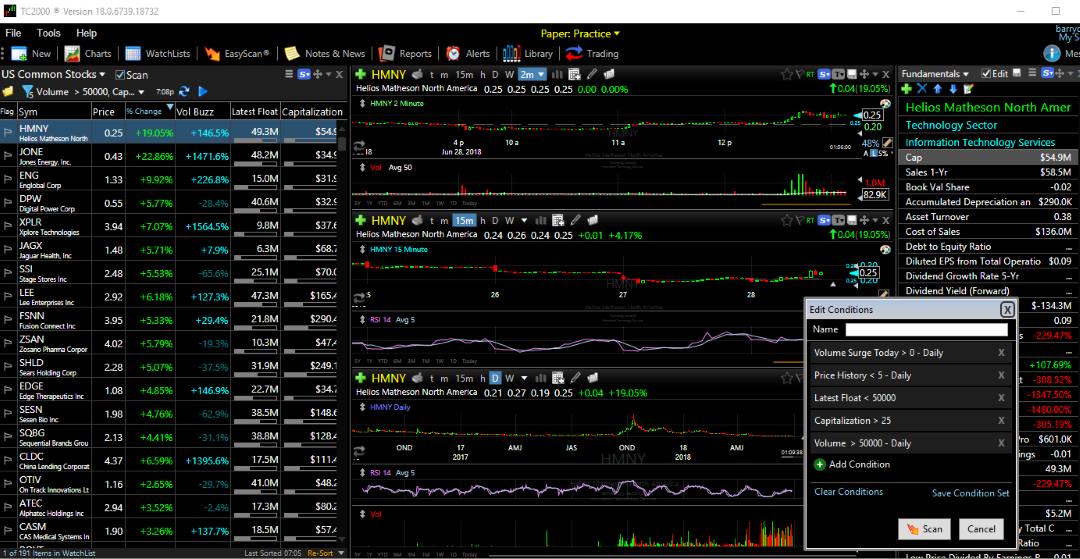

9. TC2000: Best Stock Chart Website, USA

TC2000 is the best website for US and Canadian investors wanting to trade directly from powerful charts and have the best real-time fundamental stock scanning.

Telechart has long been one of my favorite tools; I have been a Telechart Platinum subscriber for over 18 years. Endlessly customizable and scalable, the platform offers nearly everything an investor will need.

TC2000 recently released TC2000 Brokerage offering discount brokerage services at $4.95 per trade. This means a tight integration for trading stocks from the screen and one of the best implementations of stock options trading available. The advanced options, ladders, strategies, and visualizations are fantastic. Read the full TC2000 review to find out more.

If you want fundamentals screened in real-time layered with technical screens all integrated into live watch lists connected to your charts, TC2000 is a power player. Within a few clicks, you can create your own custom fundamental indicators, which even appear on the charts; it is a powerful yet simple-to-use system.

How to Invest In Penny Stocks – Short-Term

How to Invest In Penny Stocks – Short-Term

TC2000 runs on everything – your iPhone, your Tablet, your Mac, and your PC. It is priced reasonably with a simple pricing structure starting at a very low $9.99 per month.

If you trade U.S. Stocks, ETF’s or Mutual Funds, then this is a great solution. If you want to trade markets outside North America, then you will be better off selecting TradingView. Worden also provides regular live training seminars, which are of very high quality.

Technical Analysis

TC2000 has an excellent array of technical indicators and drawing tools; all the big ones are there, from OBV, RSI, and Bollinger Bands to Fibonacci Fans and Andrews Pitchfork. With over 70 different indicators, you will have plenty to play with. They have also introduced live alerts that you can configure to email or pop up if an indicator or trend line is breached. You have the ability to create custom technical indicators and conditions and even add alerts to those also. Very useful indeed.

| Visit TC2000 Now | Read the TC2000 Review |

10. Firstrade: Best Free OnlineTrading Site

Firstrade Securities has been in business for over 35 years and has gained prominence for being the first large broker to offer truly commission-free trading, located in New York in the U.S.A. Firstrade has received multiple awards for best value trading, customer service, and the “Clean Hands Kiplinger Award.”

Firstrade is still the outright winner in the commissions’ war with a $0 flat fee per trade and $0 per Options trade, and $0 per contract. But what also adds to the appeal with Firstrade is the 2,200+ commission-free Exchange Traded Funds on offer. This is a vast selection, more than the total for all the other brokers reviewed in our Top 10 Brokers Review.

You also get completely cost-free access to the suite of Morning Star research; only three other brokers offer free research of this quality.

Heatmap & Sector & Industries Tool

FirsTrade – HeatMap Helps You Find Hot Sectors

FirsTrade – HeatMap Helps You Find Hot Sectors

To find a potential opportunity to trade, you can start with the big-picture view of the market and drill down from there. The heatmap is designed for short-term traders who need to see where the price action and volatility are on any given day.

Alternatively, you can utilize the sectors and industries to evaluate past performance and select a sector to review in more depth.

The Firstrade Trading Platforms Firstrade Navigator, Options Wizards, and Real-time Watchlists hold up well against the competition. And finally, a 5-Star Customer Satisfaction Rating rounds of the package for an excellent Brokerage for mid to long-term investors.

| Read the Firstrade Review | Open a Commission Free Brokerage Account with Firstrade |

11. M1 Finance: Best Robo-Advisor Website

M1 Finance is the only Robo Advisory service we have reviewed that offers commission-free trading for their customers. This means your account will have no management fee whatsoever. Another great bonus of this mature service from M1 is that tax-loss harvesting is automatically integrated into the account. This means that when you choose to withdraw funds from your account, the algorithms will consider which securities to sell, giving priority to those that are incurring losses so that they can offset future gains.

On top of this, M1 promotes the purchase of fractional shares as a unique selling point; this means that if the portfolio you are invested in dictates a purchase of a share with a high price, you can still be fully invested with a purchase of a fraction of the share.

Another nice addition is an integrated checking account, M1 Plus, which includes a Visa card to access your funds easily.

The Investing Methodology

M1’s investing approach is based on expertly curated portfolios. Each portfolio is called a “Pie”; each pie comprises multiple stocks with specific weightings based on what risk or exposure you seek. There are close to 100 expert pies to choose from with varying levels of return and past performance. You can select an expert pie or even build your own. The great thing is that when you send funds to your account, the money is then automatically fully invested into your pie based on your allocation rules, and because there are no fees, this will not impact your account’s bottom line.

Investing Performance

M1 provides so many different expert portfolios to choose from, and depending on when you open an account and choose to invest, the returns on your investment can vary. Suffice to say, M1 claims that, on average, their expert portfolios (pies) are within or slightly above the underlying market return.

| Visit M1 Finance | Read the Full M1 Review |

12. Investors.com: Best Investing Website

Investors Business Daily (IBD) has been strongly driving their business to digital-first over the past years, but they still provide a print newspaper service. Investors Business Daily is available as a digital and print subscription. They provide a lot of their own research on stocks and use the famous CANSLIM method to evaluate the potential recommendations. The service in this review is called the IBD Leaderboard.

The IBD Leaderboard is a list of the highest-rated stocks according to the methodology behind the CAN SLIM investing strategy; this includes ratings for Current Earnings, Annual Earnings, New Products, Supply, Leaders, Institutional Sponsorship & Market Direction.

Investors Business Daily: Stock Research & Trading Plans

Investors Business Daily: Stock Research & Trading Plans

The Leaderboard services cost $828 per year, which is more expensive than Motley Fool, Stock Rover, and MorningStar. To justify this additional cost, IBD claim that they have a performance record of an average 36.6% profit per year. If this is the case, it could be well worth the investment. As part of the service, you can track watchlists, read regular market commentary, and use charts with buy and sell signals overlayed.

13. Zacks: High Performing Stock Research Site

To get full access to Zacks research reports, you will need to purchase the ZACKS Ultimate service, which costs $2995 per year. This is one of the highest-priced stock research & reporting services for individual investors in the USA. However, for this investment, you get a comprehensive service covering trade recommendations for short-term trading through income investing and longer-term growth investing strategies.

Zacks Ultimate Investment Research Services

Zacks Ultimate Investment Research Services

The Zacks Ultimate service essentially covers all of their services, including Short Selling Lists, Value Investing, ETF Investing, and Zacks Top 10 Stocks. It is probably better to decide if you want to invest or trade before you buy a Zacks subscription because if you want to invest, then the Zacks Premium service priced at a reasonable $249 per year will give you access to their top 50 stock recommendations and the Zacks #1 Rank List research reports.

Zacks claim to have one of the highest yearly returns of all the services in this review, with a +24.4% average yearly gain.

| Website | Zacks |

| Product Name | Zacks Ultimate |

| Research Reports Stocks | ✔ |

| Real-Time Research Reports | ✘ |

| Analyst Research Reports | ✔ |

| Fund Research Reports | ✔ |

| Long-Term Investing | ✔ |

| Stock Ratings | ✔ |

| Portfolio Mgt Tools | ✘ |

| Short-Term Trading | ✔ |

| Buy Signals | ✔ |

| Price Per Year | $2995 |

| Claimed Performance (Yr) | 24.4% |

14. Seeking Alpha: Good Stock Forum Website

With over 8 million users exchanging ideas on Seeking Alpha (SA), you are sure to have a constant source of inspiration. What I like about seeking Alpha is the experience level of the user community. If someone posts a sub-standard research article, the users will point it out in no uncertain terms. Registration is free, but there is also a premium marketplace for stock advisory services.

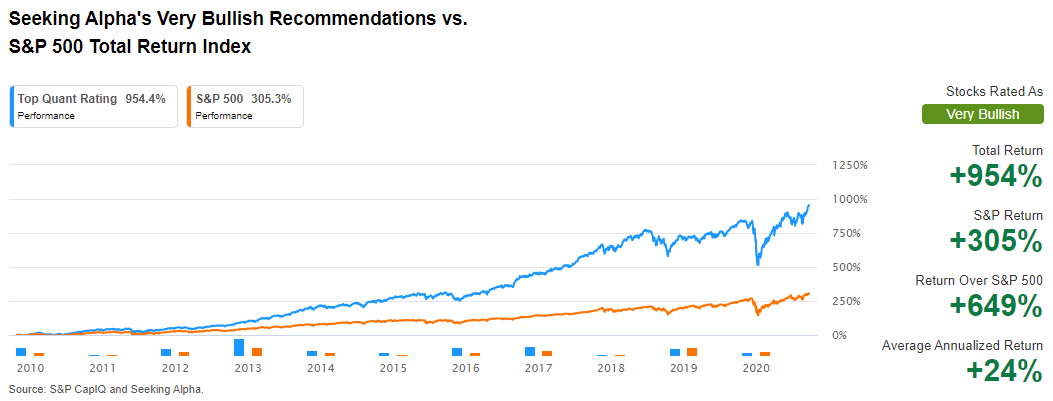

Seeking Alpha Stock Research: Quant Performance

Seeking Alpha Stock Research: Quant Performance

The real benefits to Seeking Alpha are with the Pro Service, which gives you access to all the Investing Ideas and Seeking Alpha’s Premium Ideas. Seeking Alpha PRO also includes screening and portfolio management tools and their crown jewel, the Quant Rating, for a price of $239 per year. The Quant Rating system claims to have an average annualized return of 24%

SA also makes money by allowing others to sell their stock investing strategies through their marketplace with prices ranging from $25 to $300 per month.

| Website | Seeking Alpha |

| Product Name | SA Premium Quant Ratings |

| Research Reports Stocks | ✔ |

| Real-Time Research Reports | ✘ |

| Analyst Research Reports | ✔ |

| Fund Research Reports | ✘ |

| Long-Term Investing | ✔ |

| Stock Ratings | ✔ |

| Portfolio Mgt Tools | ✘ |

| Short-Term Trading | ✔ |

| Buy Signals | ✔ |

| Price Per Year | $239 |

| Claimed Performance (Yr) | 24% |

15. Interactive Brokers: Best International Broker

No review would be complete without the grandfather of online discount brokers. Not only is Interactive Brokers (IB) a long-established company, it is also big. It has a complete set of services, enabling you to trade practically anything on any market. Stocks, Options, ETF’s, Mutual Funds, Bonds, Foreign Exchange, and even futures and commodities.

Usually, when a company is well established and large, it loses its competitive edge, not so with Interactive Brokers. Low commissions on Stock Trades at $1- and great commissions on Options demonstrate competitiveness. They also have the lowest margin interest rate in the industry.

When it comes to the trading platform, there are no additional costs as Web Trader, and TWS are free. Interactive Brokers caters to the more professional investor, or at least those with a minimum account balance of $10,000. Also, you will need to have a balance of $100,000 to be able to trade Forex.

Another huge bonus is that IB manages to throw into the package Zacks and Morning Star research for free, including real-time news.

IB manages to span the divide between Day Traders and Long-Term investors, and that is not easy. If you plan to span those worlds, also IB is a natural choice.

| In-Depth Interactive Brokers Review | Open an Interactive Brokers Account |

16. StockCharts.com: Many Exotic Chart Indicators

Worthy of strong consideration are StockCharts.com, which also comes with a solid recommendation. Worth commending are the sharp charts that are visually impressive, and its array of exotic indicators may excite the more advanced investor. One thing to mention, this service offers excellent Point and Figure Charts, which, to my knowledge, no other free service offers.

Point & Figure Charts – Old School with StockCharts.com

Point & Figure Charts – Old School with StockCharts.com

Missing trend lines, rolling EPS, and a weak news service do not do it justice. They do also offer, like the other service providers, a monthly Membership service with increased functionality.

17. Yahoo Finance: Stock Market Information Site

Yahoo has updated its interactive charting experience, it is a clean experience and full screen, so now it is actually very good. With 114 different technical indicators, you are well covered with Yahoo Finance. The interactive charts also now allow you to draw trendlines, linear regressions, and even quadrant lines. A nice new addition is that Yahoo now provides real-time quotes and charts via the BATS system.

A strong step forward for Yahoo Charts

A strong step forward for Yahoo Charts

Yahoo Finance is working hard to make its charting system a respectable alternative to other free vendors.

They have actually done something quite innovative. You can now trade stocks through the Yahoo Finance charts. This means, using Yahoo, you can trade stocks with your broker. It is a nice feature, but if you have a brokerage account, you will already have access to real-time data, charts, and quotes and can trade directly with them, so it seems a little redundant but still a step forward.

Yahoo finance does provide a news aggregation engine and actually contributes original news via the Yahoo Finance news team. If you opt for Yahoo Finance Premium, you will get a good selection of analyst research reports. These are static reports which could be useful, but again for the price tag of $49.99 per month, it might not be worth it because most mainstream brokers offer research reports for free. In fact, Firstrade offers free stock trades and research reports from both Zacks and Morningstar.

Profit & Loss & Performance Reporting

Yahoo Finance can connect to a wide variety of brokers. It can then download your stock position data and then perform analytics on your portfolio, but again you will require the overpriced Yahoo Premium subscription. There is currently no functionality in Yahoo Finance Premium for Portfolio Weighting & Rebalancing or Automated Portfolio Management.

However, they do provide reporting on your Portfolio Asset Allocation per industry sector and dividend income reporting.

[Related Article: The Top 10 Best Stock Trading Platforms. Trade From Charts]

18. Liberated Stock Trader: Best Stock Training Website

Although we should not add our own product here as it may seem biased, we believe that the Liberated Stock Trader courses offer very high-quality training at an excellent price.

The Liberated Stock Trader website was established to help educate the independent investor. We offer free stock market courses and premium stock market education.

The Liberated Stock Trader Pro Package includes 16 hours of high-quality video professionally delivered to ensure you learn every facet of the training course.

The course is broken down into 27 modules individually delivered by the author to bring together the theory and the practice to make a unique learning experience.

The video is streamed over the internet, and you will have LIFETIME ACCESS. You can watch it in the comfort of your own home. You do not need to travel to a seminar or pay hotel or flight costs.

We believe that the only person you can trust with your investment is yourself. Check out the full range of Free, Low Cost, and Premium Stock Market Training here.

19. Reuters: Good Free Stock Market News Site

Reuters.com provides good stock market and business news services for free. The news is not real-time, but it is still useful for a quick check of the markets without requiring you to log in. What is unique about the Reuters website is the ability to plot news for a stock on the chart itself; this is what sets it apart from the other charting tools.

Reuters Charts – With News Events Plotted

Reuters Charts – With News Events Plotted

The charts are basic, but they offer 35 different indicators, and you can choose to plot stock splits and dividends announcements on the chart.

20. Traders.com: Best Technical Analyst Website

Recommended for serious traders who want to learn and keep the edge over the competition continually. The Best Traders Magazine Available.

I have been a subscriber to the Technical Analysis of Stocks & Commodities Magazine (TASC) for the last nine years.

It is essentially the Go-To Managzine for experienced Technical Analysts. The magazine is very well written and has a host of high-profile contributors. I have been published in TASC, with my Side-Stepping the Next Crash” article.

The magazine covers the Technical Analysis of everything, Stocks, Options, Commodities, Bonds, Precious Metals, and Foreign Exchange.

It includes beneficial learning articles, such as developing indicators and new ways to analyze the markets. They also have a spotlight on learning new techniques for beginners and intermediate traders.

TASC also touches on the current market climate with an in-depth technical analysis of the various markets.

The contributors provide systems designed to help you get an edge in the markets whilst also covering trading systems. When a system is provided, there will be the code for the various Technical Analysis Packages such as MetaStock or TC2000, so you can implement your own indicators and systems.

As a subscriber, you also get access to the entire back catalog digitally via their website, a pure goldmine of knowledge not available anywhere else on the planet.

TIP – Go for at least a 1 Year Subscription to get access to the entire digital library.

Summary: Best Stock Market Websites

There are many high-quality websites and services available to retail investors today. If you are looking for trading, charting, and a huge active community, TradingView is a good choice. If you are a long-term investor wanting to perform your own research, the Stock Rover is a great service. If you prefer to have the research done for you, then Motley Fool Stock Advisor is highly recommended. If you want to actively trade with high probability signals, then Trade Ideas is your only choice.

Join Over 25,000 Liberated Stock Traders

Get the Latest Stock Market Software, Books & Movie Reviews Directly To Your Inbox

| Email Address |

Additional Recommended Financial Blogs & Websites

Best Site for Investing Books

Self-education can be a good source of information to get started, and reading the best books in the business is a great place to begin. Read our review of the Top 20 Stock Market Books ever written.

Self-education can be a good source of information to get started, and reading the best books in the business is a great place to begin. Read our review of the Top 20 Stock Market Books ever written.

We also have selected the best books for value & income investors.

Best Site for Investing Audio Books

Do you not have time to read a book, then do what I do listen to one. Our review of the Top 20 Best Audiobooks provides you with a list of entertaining and educational stock market books.

Do you not have time to read a book, then do what I do listen to one. Our review of the Top 20 Best Audiobooks provides you with a list of entertaining and educational stock market books.

Also, check out the Liberated Stock Trader Podcast.

Best Page for Stock Market Movies

You can actually learn a huge amount from watching a film. Some of my biggest Aha moments have come from movies like Inside Job (2011) and The Corporation (2003). Take a look at our Best Stock Market Movies Review.

You can actually learn a huge amount from watching a film. Some of my biggest Aha moments have come from movies like Inside Job (2011) and The Corporation (2003). Take a look at our Best Stock Market Movies Review.

Other Good Investing Websites & Blogs

Abnormal Returns – Tadas Viskanta provides an excellent resource for great articles and perspectives from finance sites across the web, well worth following.

Value Stock Guide – Provides insightful lessons on Value Stock Picking and the Stock Market with a regular newsletter and advice.

Do you want your website featured here, contact us